Support and Resistance Trading Strategy

In the world of trading, whether in stocks, forex, or cryptocurrencies, technical analysis plays a crucial role in decision-making. Among the various concepts, support and resistance are two of the most fundamental and widely used principles. These levels are essential for traders who rely on price action to predict market movements. Understanding and applying a support and resistance trading strategy is a powerful way to enhance your trading performance and avoid common pitfalls.

This guide explores what support and resistance are, how to identify them, and how to incorporate these concepts into your trading strategy, including the nuances of breakout trading, combining these levels with other technical indicators, and common mistakes to avoid. By the end of this article, you’ll have a strong understanding of how to use support and resistance levels to improve your trading results.

What Are Support and Resistance Levels?

Support is a price level where a downward trend tends to pause due to a concentration of buying interest. This buying activity prevents the price from falling further, often leading to a reversal. Think of support as a “floor” that prices struggle to break through. When the price reaches this level, demand increases, and buyers enter the market, potentially causing a rebound.

Resistance, on the other hand, is the opposite. It’s the price level where an upward trend starts to weaken as selling pressure overcomes buying pressure. This is like a “ceiling” that the price finds hard to break. Once the price hits a resistance level, the supply increases, and sellers become dominant, causing the price to reverse or consolidate.

These levels are not just arbitrary numbers on a chart; they represent zones of increased interest from both buyers and sellers. Traders often rely on these levels to gauge where market participants will likely react, making them critical for placing trades, setting stop-loss orders, and managing risk.

Why Support and Resistance Matter

Support and resistance levels are so important because they highlight areas where the market has a history of reversing or consolidating. These levels can help traders anticipate price movements, as markets tend to respect these boundaries—bouncing off support and resistance, or, in the case of breakouts, moving strongly once they’ve been breached.

Key reasons why support and resistance matter in trading:

- Price Reaction Zones: These levels act as focal points where prices often react, leading to either a reversal or a breakout. Knowing these zones allows traders to predict the most likely movement of price action.

- Psychological Impact: Support and resistance levels reflect the collective psychology of market participants. Investors and traders tend to place buy and sell orders at these levels, reinforcing their importance.

- Risk Management: Traders can place their stop-loss orders just above resistance or below support to protect against unexpected price movements. Proper identification of these levels is crucial to minimizing risk.

- Timing Entries and Exits: Support and resistance provide guidance for entering or exiting trades. For example, a trader might enter a long position near a support level and exit near a resistance level, or vice versa.

How to Identify Support and Resistance Levels

Accurately identifying support and resistance levels is essential for successful trading. There are several methods traders use to spot these critical levels:

-

Historical Price Levels

The simplest method of identifying support and resistance is by observing past price action. Traders look for areas where the price has previously struggled to move higher (resistance) or lower (support). These areas often serve as future barriers, as market participants remember these levels and react accordingly.

For example, if a stock has bounced multiple times off a price of $50, then $50 becomes a significant support level. If it has been unable to rise above $60, that level becomes resistance. Chart patterns like double tops or bottoms are also common indicators of support and resistance zones.

-

Trendlines

Trendlines are diagonal lines drawn on a chart to connect a series of price points, typically highs or lows, that show the general direction of the market. An upward trendline, which connects a series of higher lows, acts as dynamic support. A downward trendline, connecting lower highs, serves as dynamic resistance.

These lines are helpful for identifying support and resistance in trending markets, where the price doesn’t move horizontally but follows a specific trajectory. Trendlines can also be used in conjunction with other indicators to confirm potential trading opportunities.

-

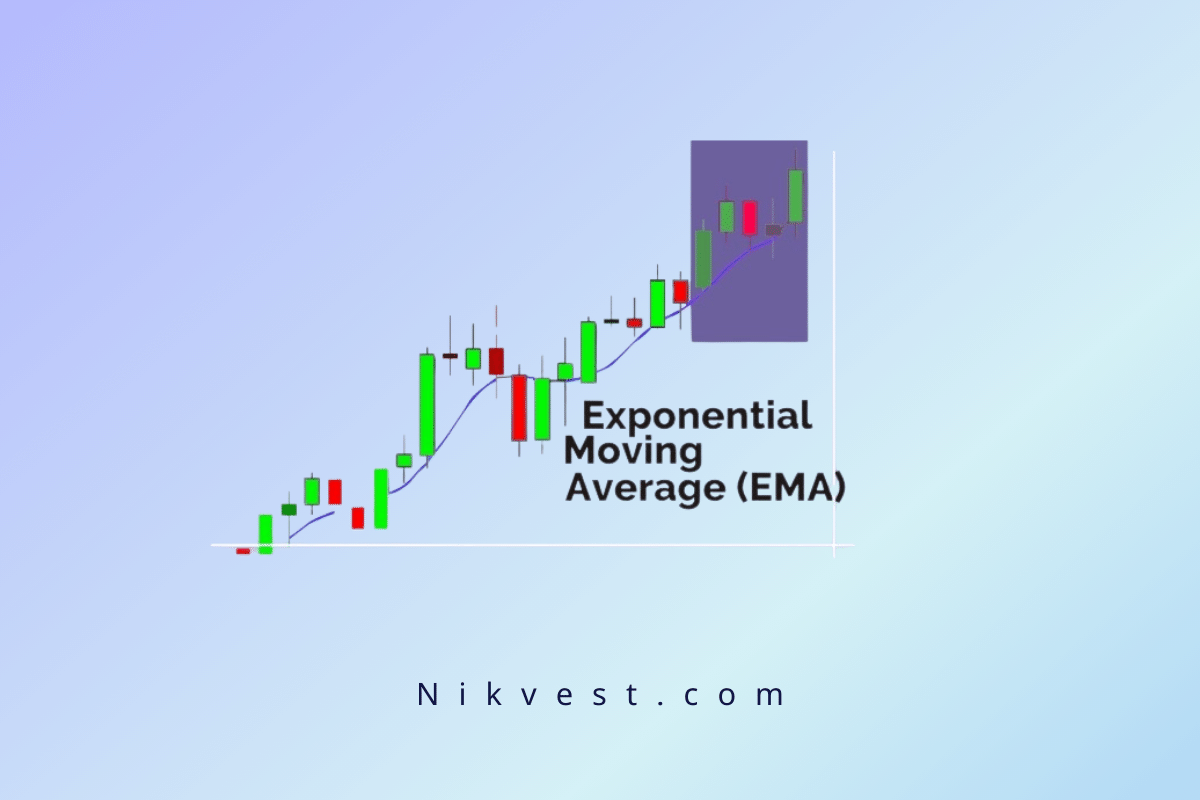

Moving Averages

Moving averages are popular technical indicators that smooth out price data to create a constantly updated average price. They can act as support and resistance depending on the market conditions. For example, in an uptrend, the price might repeatedly bounce off the 50-day moving average, using it as support. In a downtrend, the price might struggle to rise above the 200-day moving average, which acts as resistance.

Commonly used moving averages include the 50-day and 200-day moving averages, both of which are watched by institutional traders and individual investors alike.

-

Fibonacci Retracement Levels

Fibonacci retracement levels are a series of horizontal lines drawn on a price chart that represent potential support and resistance levels based on the Fibonacci sequence. The key levels are 23.6%, 38.2%, 50%, 61.8%, and 100%. These levels help traders identify where potential reversals might occur.

Many traders use Fibonacci retracement in conjunction with other methods, as they often coincide with other support or resistance levels, making them more reliable.

-

Psychological Levels

Round numbers, such as 100, 1,000, or 10,000, often act as psychological support and resistance levels. This is because many traders and investors tend to place buy or sell orders around these numbers, which leads to price reactions near these levels. These “psychological barriers” are especially prominent in forex and stock trading.

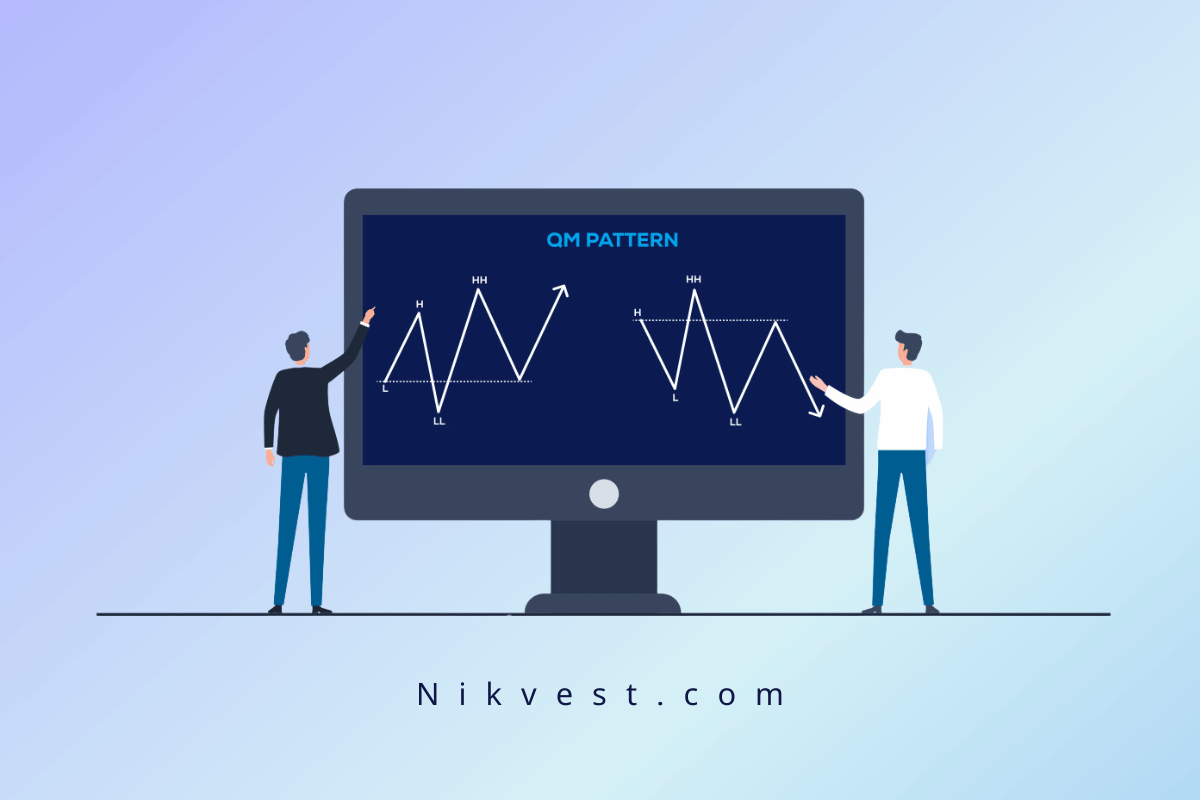

Types of Support and Resistance

Support and resistance levels can be classified into two categories: static and dynamic.

Static Support and Resistance

Static support and resistance levels remain at the same price point over time. Examples of static levels include horizontal support and resistance drawn from historical highs and lows, psychological levels, and Fibonacci retracements.

Dynamic Support and Resistance

Dynamic support and resistance levels change as the market evolves. Trendlines and moving averages are examples of dynamic support and resistance. As the price moves, these levels adjust to provide a changing framework for traders to consider.

How to Trade Support and Resistance Levels

Now that we understand what support and resistance levels are and how to identify them, the next step is learning how to use them in actual trading. There are two primary strategies for trading support and resistance: trading the bounce and trading the breakout.

-

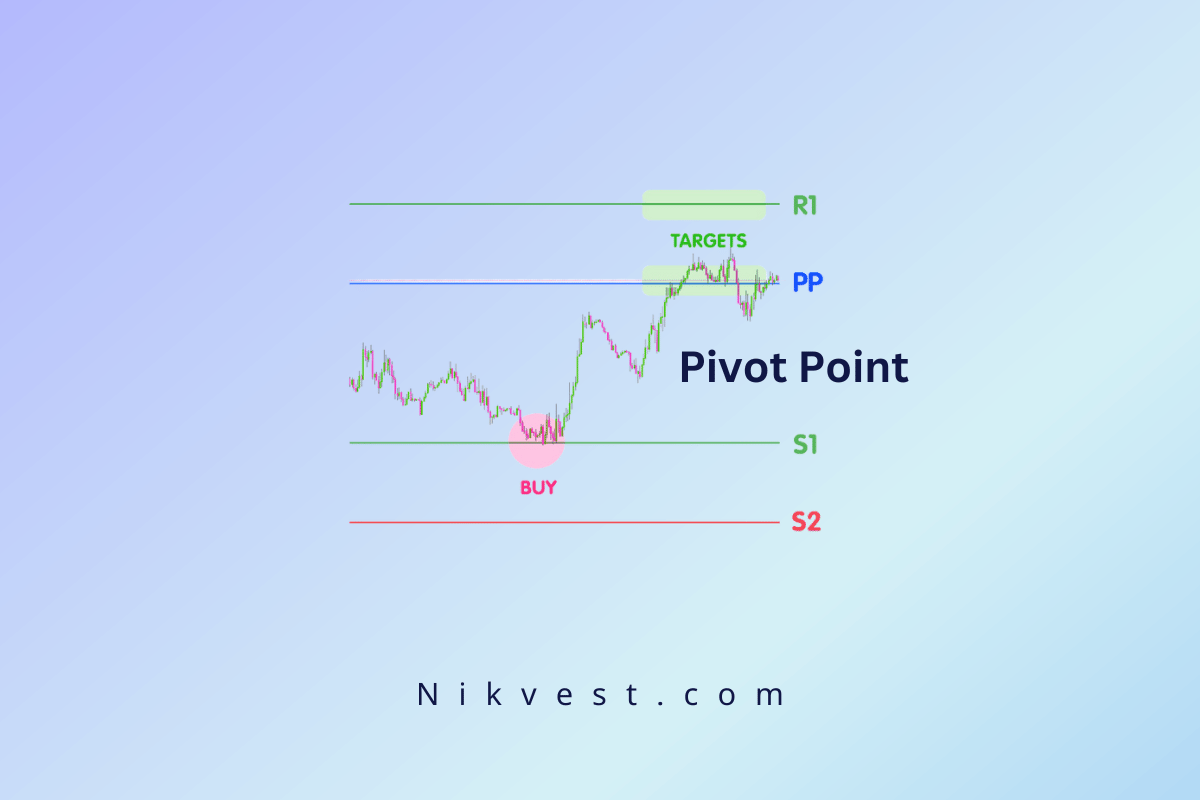

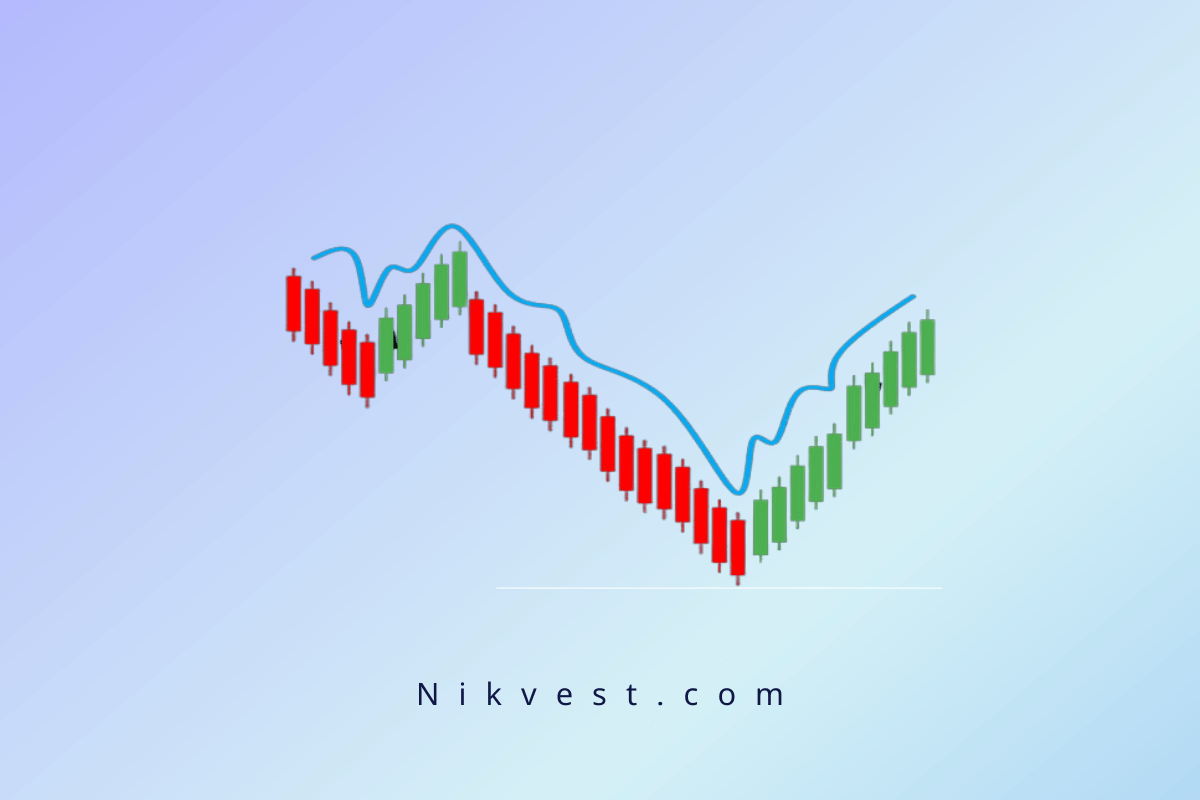

Trading the Bounce

When the price approaches a support or resistance level, one of two things can happen: it can either break through the level or bounce off it. In bounce trading, we anticipate that the price will respect the support or resistance level and reverse direction.

Steps to Trade the Bounce:

– Identify the Support or Resistance Level: Look for a well-established level where the price has bounced multiple times. The more times the price has respected a level, the stronger it is.

– Wait for Confirmation: Don’t rush into a trade. Wait for price action to confirm that the level is holding. Candlestick patterns such as a hammer or a bullish engulfing pattern near support, or a shooting star or bearish engulfing near resistance, can serve as confirmation.

– Enter the Trade: Enter a long position if the price bounces off support or a short position if it bounces off resistance. You want to enter after confirmation to reduce the risk of false signals.

– Set Stop Loss and Take Profit: For long trades, place a stop loss just below the support level. For short trades, place a stop loss just above the resistance level. Set your take profit level near the next support or resistance level.

Bounce trading is a conservative approach that works well when markets are range-bound or moving sideways. It’s also a strategy that relies on patience and timing.

-

Trading the Breakout

While bounce trading involves assuming that a level will hold, breakout trading is based on the idea that a support or resistance level will eventually give way. Breakouts occur when the price moves decisively through a support or resistance level, often leading to large price moves as traders rush in to take advantage of the momentum.

Steps to Trade the Breakout:

– Identify a Strong Support or Resistance Level: Look for a level that the price has tested multiple times without breaking through. The more attempts to break the level, the more significant the breakout is likely to be.

– Wait for a Clear Break: Don’t enter a trade on the first sign of a breakout. Wait for confirmation that the price has decisively broken through the level, such as a strong candlestick close beyond the support or resistance level.

– Look for a Retest: After a breakout, the price often returns to retest the broken level before resuming its move. This is an ideal opportunity to enter the trade with reduced risk.

– Set Stop Loss and Take Profit: Place a stop loss just below the broken resistance or above the broken support to protect against false breakouts. Target the next support or resistance level as your take profit.

Breakouts can offer significant profits if timed correctly, but they also come with risks. False breakouts—when the price briefly moves beyond a level only to reverse—are common, so patience is essential.

Combining Support and Resistance with Other Indicators

To increase the reliability of support and resistance levels, traders often combine them with other technical indicators. This helps confirm potential trade setups and increases the probability of success.

-

Relative Strength Index (RSI)

The Relative Strength Index (RSI) is a momentum oscillator that measures the speed and change of price movements. It ranges from 0 to 100 and is typically used to identify overbought or oversold conditions in a market. When combined with support and resistance, RSI can offer powerful insights into the strength of a price level.

– Overbought Conditions: If the price is approaching a resistance level and the RSI is above 70 (indicating overbought conditions), this may signal a potential reversal. The combination of overbought conditions and resistance suggests that the price might struggle to break through and could reverse or consolidate.

– Oversold Conditions: On the other hand, if the price is nearing a support level and the RSI is below 30 (indicating oversold conditions), this could indicate that the price is likely to bounce. In such a case, the market could be ripe for a reversal or a bullish move from the support level.

Using RSI with support and resistance allows traders to filter out false signals and increases confidence in trade entries and exits.

-

Moving Averages

Moving averages (MAs) are widely used in trading to identify trends and smooth out price data. The 50-day and 200-day moving averages are particularly popular in identifying long-term trends. They can act as dynamic support or resistance levels as the price moves along with the trend.

– Support in Uptrends: When the price is trending upwards, the moving average (especially the 50-day or 200-day MA) often acts as support. A trader can enter a long position when the price bounces off the moving average, with confirmation from a nearby support level.

– Resistance in Downtrends: In a downtrend, the moving average can act as dynamic resistance. If the price fails to break through the moving average and a resistance level aligns with it, this could signal a good opportunity to enter a short position.

By combining moving averages with support and resistance, traders can better time their trades, knowing that multiple factors are reinforcing a potential price reaction.

-

Bollinger Bands

Bollinger Bands are volatility indicators that consist of a middle band (usually a 20-period simple moving average) and two outer bands that represent two standard deviations from the middle band. These bands expand and contract based on market volatility, making them useful for identifying potential breakout opportunities.

When the price approaches a support or resistance level, traders can look at Bollinger Bands to assess whether the market is overextended:

– Resistance and Upper Band: If the price is near a resistance level and is also hitting the upper Bollinger Band, this suggests that the asset is overbought and may reverse.

– Support and Lower Band: If the price is near a support level and touching the lower Bollinger Band, it could indicate that the asset is oversold and a bounce is likely.

Bollinger Bands help traders determine if the market is overbought or oversold at key support or resistance levels, making them a valuable tool for filtering trade setups.

-

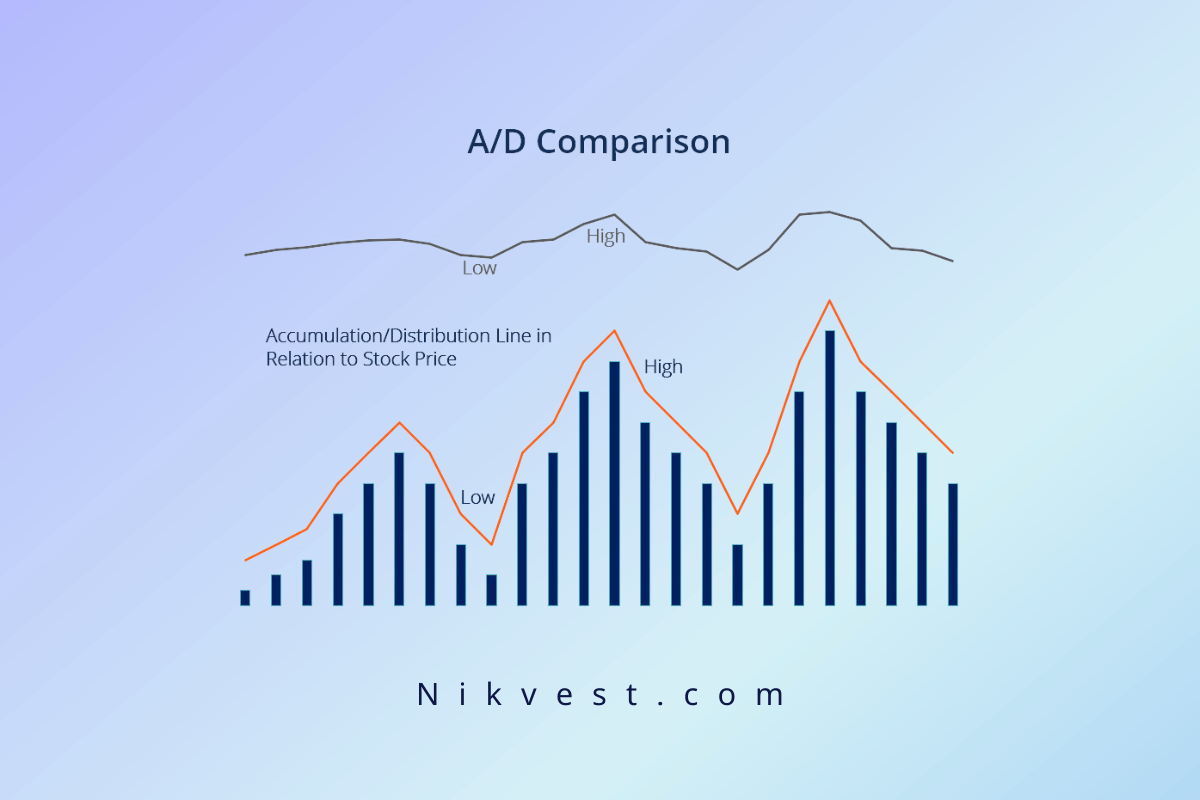

Volume

Volume is a critical aspect of any trading strategy and plays a significant role when trading support and resistance. When the price approaches a key level, the strength of the volume can help confirm whether the price is likely to break through or bounce.

– Breakout with High Volume: A breakout through a support or resistance level with high trading volume is more likely to be sustained. The high volume indicates strong participation by market players, which reinforces the validity of the breakout.

– Weak Volume on Approach: If the price approaches a support or resistance level with declining volume, it could indicate that the momentum behind the move is weakening. This may suggest that the price is more likely to bounce than break through the level.

Volume analysis can help traders avoid false breakouts and confirm the strength of a bounce. By adding volume to your support and resistance strategy, you increase the likelihood of identifying significant price movements.

Common Mistakes When Trading Support and Resistance

Even though support and resistance trading is a powerful strategy, there are several common mistakes traders make that can lead to losses or missed opportunities. By recognizing these mistakes, you can refine your strategy and improve your results.

-

Ignoring Timeframes

One of the most common mistakes is focusing too heavily on a single timeframe. Support and resistance levels can differ depending on the timeframe you’re trading. For instance, a level that seems strong on a 15-minute chart may not hold up on a daily chart. It’s important to always consider higher timeframes to confirm the significance of a support or resistance level.

– Tip: Use multiple timeframes to confirm support and resistance levels. A level that holds on a daily chart is more reliable than one on a smaller, intra-day timeframe.

-

Entering Trades Prematurely

Another mistake traders make is jumping into trades without waiting for confirmation. Just because the price has reached a support or resistance level doesn’t mean it will automatically reverse or break through. It’s important to wait for price action confirmation, such as a candlestick pattern or volume spike, before entering a trade.

– Tip: Be patient and wait for clear confirmation of a bounce or breakout before entering the trade. Candlestick patterns, volume increases, or oscillator signals like RSI can serve as confirmation tools.

-

Overlooking False Breakouts

False breakouts are a common occurrence, especially in volatile markets. A false breakout happens when the price breaks through a support or resistance level, only to quickly reverse and trap traders who entered early.

– Tip: To avoid false breakouts, wait for the price to close beyond the level and confirm the breakout on multiple timeframes. Using a retest of the broken level for entry can also reduce the risk of getting caught in a false breakout.

-

Over-Reliance on Static Levels

While horizontal support and resistance levels are useful, relying solely on static levels can lead to missed opportunities. Dynamic support and resistance levels, such as trendlines and moving averages, provide additional context and help traders navigate trending markets.

– Tip: Incorporate dynamic support and resistance tools like moving averages, trendlines, and Fibonacci retracements into your strategy to get a more complete picture of the market.

Setting Stop Loss and Take Profit Using Support and Resistance

Risk management is an essential component of any successful trading strategy, and support and resistance levels provide a solid framework for setting stop-loss and take-profit orders.

-

Stop Loss Placement

When trading based on support and resistance, the stop loss should be placed beyond the level you are trading. For example, if you are buying at a support level, place your stop loss just below the support. If you are shorting at a resistance level, place your stop just above the resistance.

By placing your stop loss beyond the support or resistance, you protect yourself from unexpected market moves while allowing the trade to have some breathing room.

-

Take Profit Placement

Your take-profit level should be placed near the next support or resistance level. If you are trading a bounce off support, your take profit can be set at the next resistance level, and vice versa for short trades. You can also use a measured move approach, where the distance between the support and resistance serves as a guide for setting your take-profit level.

-

Risk-Reward Ratio

Always ensure that your risk-reward ratio makes sense for the trade. A typical risk-reward ratio of 1:2 or better means you are risking one unit of capital for the potential to gain at least two units. This way, even if only half of your trades are successful, you can still achieve profitability.

Psychological Significance of Support and Resistance

Support and resistance levels are not just technical constructs; they are deeply connected to the psychology of the market. These levels often reflect the behavior of market participants, including institutional traders, retail investors, and high-frequency trading algorithms.

– Herd Behavior: Many traders place orders near significant support and resistance levels, which creates herd behavior. This self-fulfilling prophecy reinforces the importance of these levels.

– Market Sentiment: Support and resistance levels can act as sentiment indicators. When a support level holds, it suggests that buyers are confident in the asset’s value. When resistance is broken, it indicates strong market confidence in upward momentum.

Understanding the psychological impact of support and resistance can give you an edge in anticipating market reactions and adjusting your strategy accordingly.

Conclusion

The support and resistance trading strategy is one of the cornerstones of technical analysis and is applicable across various financial markets, including stocks, forex, commodities, and cryptocurrencies. By learning to identify and trade these levels effectively, traders can gain a significant advantage in timing entries, managing risk, and maximizing profit potential.

Remember that successful support and resistance trading requires more than just recognizing price levels. It involves combining these levels with other technical indicators, waiting for price confirmation, and practicing proper risk management. Whether you’re trading bounces or breakouts, this strategy, when executed with patience and discipline, can become a valuable tool in your trading arsenal.