OBV Indicator: A Key to Understanding Money Flow in Markets

The OBV (On-Balance Volume) indicator is considered one of the critical tools in technical analysis. By examining trading volume and aligning it with price changes, this tool offers profound insights to market analysts. The main application of OBV is to identify market trends and trading opportunities. According to this indicator, when trading volume increases along with rising stock prices, it indicates the strength of the upward trend. Similarly, if trading volume grows while prices decline, it signals a downward trend.

Using the OBV indicator helps investors make more informed decisions. By analyzing this indicator, traders can identify the best times to enter or exit a trade. In other words, OBV acts as an early signal for potential price changes by analyzing trading volume.

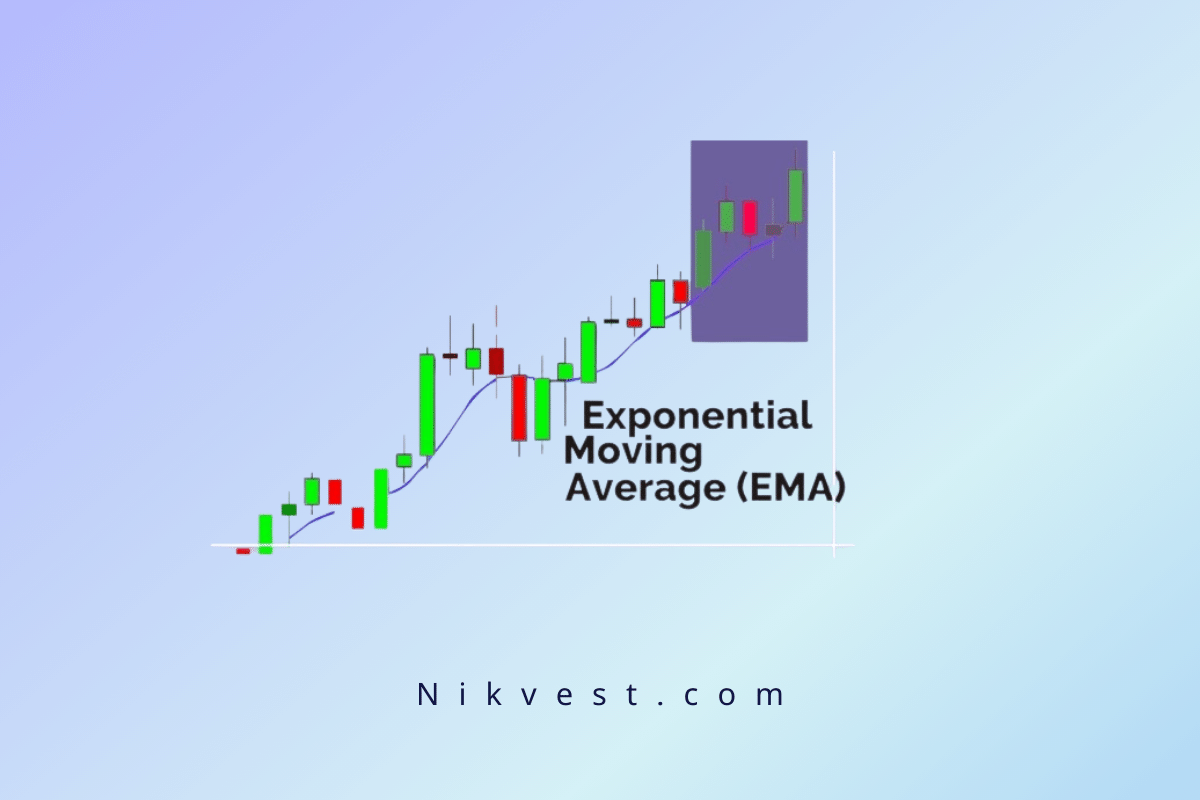

To use the OBV indicator effectively, it is essential to pay attention to sudden changes in trading volume. Such changes may indicate a shift in the trend or the reinforcement of the current trend. Additionally, combining the insights gained from OBV with other indicators and analytical tools can enhance the accuracy of the analysis. For example, combining OBV with indicators like moving averages or RSI can create a comprehensive and powerful analytical strategy.

Ultimately, analysts must remember that no indicator alone can provide a complete picture of the market. Smartly combining OBV with other analytical tools can significantly improve trading strategies.

OBV, or On-Balance Volume, is an advanced technical analysis tool recognized as a volume and price indicator. It falls under the momentum category and is used to gauge the volume flow in different stocks. The primary purpose of OBV is to predict future price changes in upcoming candlesticks by analyzing the flow of volume.

Joseph Granville first introduced this tool. The OBV indicator predicts market movements by measuring changes in trading volume based on stock price movements.

The significance of volume changes in stock markets is unparalleled. Utilizing the OBV (On-Balance Volume) indicator as a critical parameter in market analysis can provide valuable insights into the driving forces behind market movements. This indicator serves as a vital metric, analyzing trading volume and revealing the relationship between volume and price changes.

To effectively use the OBV indicator, traders should look for significant changes in trading volume, as these shifts may signal potential market trend reversals. Combining the data derived from OBV with other indicators, such as moving averages or the RSI, can enhance and refine market analysis.

It’s essential to remember that no single indicator provides a complete view of the market. Using OBV alongside other analytical tools helps traders improve their trading strategies.

OBV Indicator Settings

The proper configuration and optimal use of the OBV (On-Balance Volume) indicator are crucial in technical analysis. This indicator examines the relationship between trading volume and stock price changes, helping traders identify significant and decisive market movements. When trading volume increases substantially, it may indicate that large investors and funds are entering the stock, suggesting an upward trend in the coming days.

As volume changes, OBV can reflect the entry of “smart money” into the stock, often done to drive up prices. The OBV compares volume fluctuations with the stock’s price momentum, providing significant information for analysts to make more informed decisions.

By incorporating OBV with other tools, traders can better understand the market’s momentum and identify potential opportunitmarket’sprofitable trades.

The OBV (On-Balance Volume) indicator is also useful for identifying the beginning of a new market trend. If the OBV shows higher highs, it indicates the formation of an upward trend. Conversely, if the OBV shows lower lows, it can signal the start of a downward trend.

Thus, when combined with other analytical tools, a precise interpretation of the OBV indicator can strengthen and enhance market analysis. Understanding how volume changes can affect stock prices is vital for any trader. Using OBV helps traders identify investment opportunities and improve their trading strategies with reliable information.

OBV Indicator Analysis

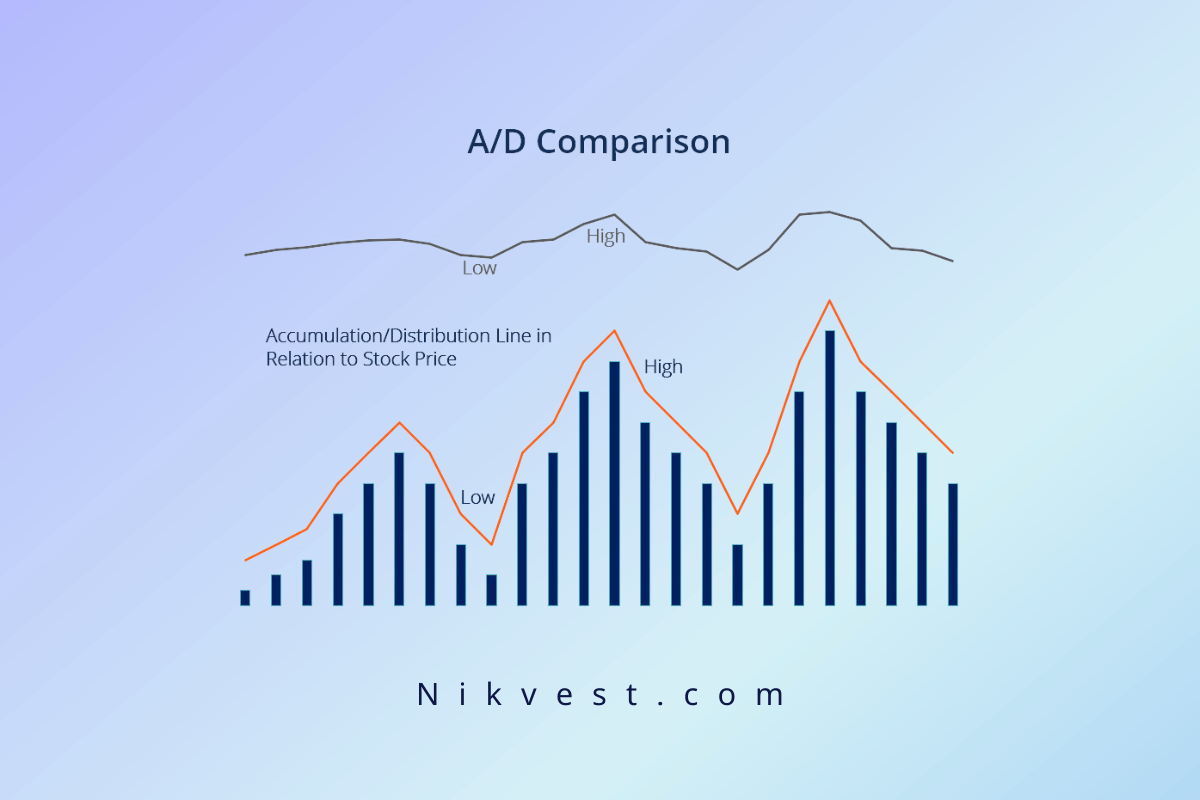

An effective strategy for using the OBV (On-Balance Volume) indicator in technical analysis provides a fresh perspective for market analysts. The OBV indicator helps traders identify market strengths and weaknesses by combining trading volume with stock price changes. In OBV, when the stock price closes higher than the previous day, and trading volume is positive, it signals an upward trend.

Similarly, if the stock price closes lower than the previous day and trading volume is negative, the OBV indicates a downward trend. The OBV line is formed by summing up these positive and negative volumes.

By monitoring these patterns, traders can gain insights into the market’s momentum and make more informed decisions on whether the markets should continue holding a position or prepare for a reversal.

Paying close attention to the OBV (On-Balance Volume) indicator’s behavior is crucial to implementing an effective trading strategy. When the OBV is in an upward trend, it signals buying pressure, which may increase stock prices. Similarly, a downward OBV suggests selling pressure and the possibility of future price declines.

In such situations, buying when the volume is positive and selling when the volume is negative is recommended. Additionally, when price increases align with increasing trading volume, it confirms the upward trend in the market.

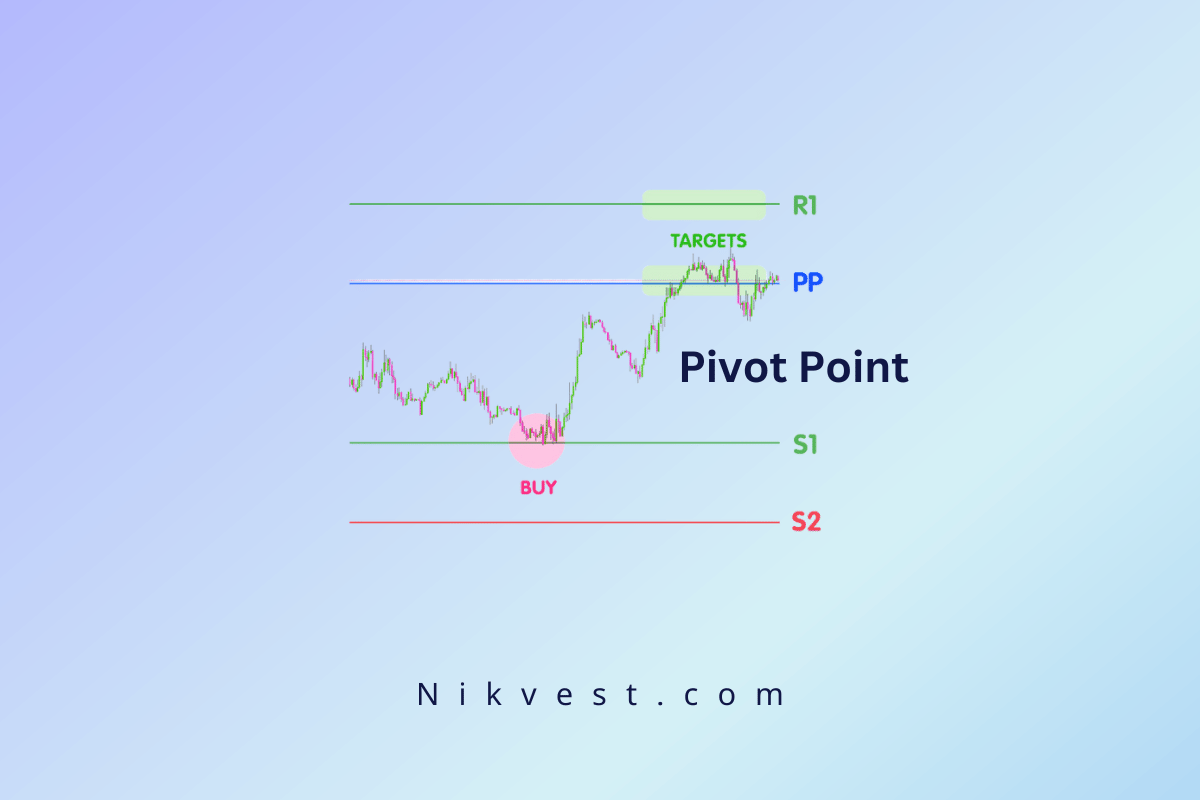

Monitoring the OBV line and its overall trend is critical in a trading strategy. It is always essential to compare the OBV trend with the stock’s overall price chart. Moreover, assessing the support and resistance levels of the price chart alongside the OBV is essential. If these levels are breached, the OBV trend may shift, reflecting changes in trading volume.

OBV Indicator Formula

The formula for the OBV (On-Balance Volume) indicator is one of the fundamental tools in technical analysis. It helps traders analyze the flow of capital and trading volume in a particular asset. This formula is based on the previous OBV level and the latest trading volume.

There are three scenarios for calculating OBV:

- If the closing price is higher than the previous closing price, the OBV is calculated as follows:

- OBV = Previous OBV (OBVprev) + Trading Volume (Volume).

- If the closing price is equal to the previous closing price, there is no change in OBV:

- OBV = Previous OBV (OBVprev) + 0.

- If the closing price is lower than the previous closing price, the OBV decreases as follows:

- OBV = Previous OBV (OBVprev) – Trading Volume (Volume).

The OBV represents an asset’s cumulative total of current trading volume, indicating whether the volume flows into or out of the stock. This information helps traders determine if price movements are confirmed by trading volume.

Analyzing OBV can indicate the overall market trend and assist traders in making better trading decisions. This information becomes especially significant when a match or mismatch between volume and price occurs. At times, changes in trading volume can signal potential market trend shifts, which analysts can use to identify trading opportunities and risks.

Sample Calculation of the OBV Indicator

To better understand how the OBV (On-Balance Volume) indicator works, let’s consider a practical example with the following data over a trading week:

- Day 1:

- Closing price: 20,000 Rials

- Trading volume: 360,000 shares

- Day 2:

- Closing price: 20,105 Rials

- Trading volume: 400,000 shares

- Day 3:

- Closing price: 20,117 Rials

- Trading volume: 370,000 shares

- Day 4:

- Closing price: 20,100 Rials

- Trading volume: 420,000 shares

- Day 5:

- Closing price: 20,050 Rials

- Trading volume: 350,000 shares

- Day 6:

- Closing price: 20,075 Rials

- Trading volume: 450,000 shares

- Day 7:

- Closing price: 20,090 Rials

- Trading volume: 470,000 shares

- Day 8:

- Closing price: 20,090 Rials

- Trading volume: 310,000 shares

According to the OBV formula, if the closing price of the current day is higher than the previous day’s, the volume is added to the OBV. If it’s lower, the volume is subtracted from the OBV. If the price remains the same, the OBV remains unchanged.

OBV Calculations:

- Day 1: Initial OBV is 0.

- Day 2: OBV = 0 + 360,000 = 360,000 (Price is higher)

- Day 3: OBV = 360,000 + 400,000 = 760,000 (Price is higher)

- Day 4: OBV = 760,000 – 420,000 = 340,000 (Price is lower)

- Day 5: OBV = 340,000 – 350,000 = -10,000 (Price is lower)

- Day 6: OBV = -10,000 + 450,000 = 440,000 (Price is higher)

- Day 7: OBV = 440,000 + 470,000 = 910,000 (Price is higher)

- Day 8: OBV remains unchanged at 910,000 (Price is the same)

This example shows how OBV helps analysts understand the relationship between trading volume and price movements. The OBV can provide insights into future price movements, helping traders make more informed decisions.

OBV in TradingView

Using the OBV (On-Balance Volume) indicator in cryptocurrency trading can enhance trading strategies. However, to achieve the best results, understanding critical rules is essential:

- Identifying Trends:

OBV is most effective in trending markets (bullish or bearish). It may not provide accurate results in neutral or low-volatility markets. Recognizing the current market trend is crucial for the effective use of OBV. - Matching Timeframes:

Aligning the chart’s timeframe with the OBV’s timeframe is important for precise analysis. For example, using daily OBV data to analyze a weekly chart may result in confusion. Platforms like TradingView automatically adjust timeframes, making it easier for traders to analyze. - Combining with Other Indicators:

OBV alone may not provide a complete picture. Combining it with other tools, like RSI or moving averages, can give traders a clearer understanding of market conditions. - Beware of False Signals:

OBV can sometimes generate false signals, especially in highly volatile markets. Traders should always seek confirmation from other indicators before making trading decisions based on OBV signals.

By following these guidelines, cryptocurrency traders can use OBV more effectively, helping them identify profitable opportunities and minimize trading risks.

Limitations of the OBV Indicator

When using the OBV (On-Balance Volume) indicator in technical analysis, it’s essential to recognize its limitations and potential risks. While this indicator provides valuable information about trading volume and its impact on stock prices, it should not be relied upon entirely as a standalone strategy.

One major limitation of OBV is that it can sometimes generate false signals. OBV relies on volume data, which can be influenced by external factors such as news, rumors, or significant shareholder movements that may not reflect the market trend.

Moreover, in cases where there is a sudden spike or drop in trading volume, OBV may temporarily become less effective. For example, a sudden increase in volume could be driven by short-term events that do not hold long-term significance for analysts.

Therefore, it is recommended that OBV be used alongside other indicators and analytical tools. Combining OBV data with other analysis methods can help analysts create a more comprehensive view of the market and more accurately identify trading opportunities. This multifaceted approach allows traders to adjust their strategies with a broader perspective and more precise information.

Final Thoughts

The OBV (On-Balance Volume) indicator has become widespread among stock market traders. By focusing on trading volume, OBV enables analysts to examine the relationship between volume changes and price movements. Analyzing this data provides a deeper understanding of buying and selling pressures in the market.

OBV evaluates changes in trading volume and aligns them with price movements, helping traders gain insights into market forces. These insights can assist analysts in more accurately predicting the next market trend.

However, to enhance the accuracy of analyses, it is recommended that OBV be used in conjunction with other indicators and analytical tools. Combining OBV data with indicators such as RSI or moving averages can help traders obtain a clearer market picture.

Ultimately, using OBV alongside other tools allows traders to develop more effective trading strategies and analyze the stock market from a broader perspective. This multi-dimensional approach to market analysis can help reduce risks and increase profitability opportunities.