Parabolic SAR Trend Strategy

In the fast-paced world of trading, the ability to accurately identify trends and reversals is critical for maximizing profits and minimizing losses. Among the various technical analysis tools available, one that stands out for its simplicity and effectiveness is the Parabolic SAR (Stop and Reverse). Initially developed by the renowned technical analyst J. Welles Wilder in 1978, the Parabolic SAR has since become a staple in the toolkits of many traders.

This guide will explore what the Parabolic SAR is, how it’s calculated, how to use it in trading—especially in the context of forex—and the pros and cons of this indicator. We’ll also touch upon advanced strategies for maximizing its utility, settings adjustments, and how it compares to other trend-following indicators.

What is the Parabolic SAR?

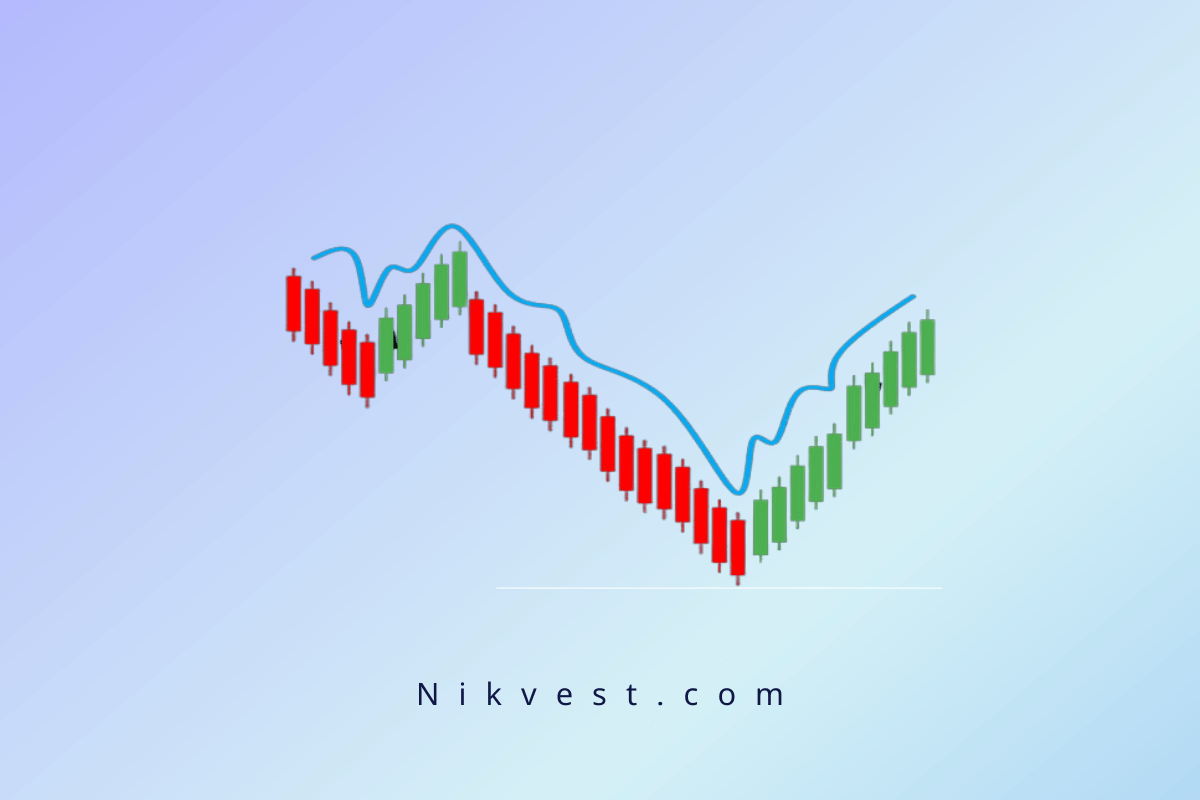

The Parabolic SAR is a technical indicator designed to identify the direction of an asset’s price movement and to provide potential entry and exit points. SAR stands for Stop and Reverse, meaning that the indicator helps traders determine when to exit a position and possibly enter a new one in the opposite direction.

The indicator appears on a price chart as a series of dots that follow the price action. These dots are plotted either above or below the price:

– Dots below the price indicate that the market is in an uptrend.

– Dots above the price indicate that the market is in a downtrend.

As long as the dots stay below the price during an uptrend or above the price during a downtrend, the current trend is considered intact. However, when the dots flip to the opposite side, this is a signal that the trend may be reversing.

The Importance of Trend Identification in Trading

Traders and investors often seek to ride trends because they represent the momentum of the market. Being able to follow a trend can result in significant profits, while trading against the trend can often lead to losses. The Parabolic SAR excels in helping traders identify and follow trends, making it an essential tool in various markets, including stocks, commodities, and particularly forex.

How is the Parabolic SAR Calculated?

The Parabolic SAR is calculated based on the following formula:

For an Uptrend:

SAR = Prior SAR + AF (EP – Prior SAR)

For a Downtrend:

SAR = Prior SAR – AF (Prior SAR – EP)

Where:

– SAR refers to the current value of the Parabolic SAR.

– Prior SAR is the previous period’s SAR value.

– AF is the acceleration factor, which starts at 0.02 and increases by 0.02 each time the price makes a new high (in an uptrend) or a new low (in a downtrend). The maximum value of the AF is 0.20.

– EP (Extreme Point) represents the highest high or lowest low during the current trend.

The key component in the formula is the acceleration factor (AF), which adjusts as the trend progresses. The acceleration factor increases when the price continues in the same direction, causing the SAR to catch up to the price faster. The idea is that as the trend gains strength, the SAR becomes more sensitive and helps traders lock in profits by moving their stop-loss closer to the price action.

Parabolic SAR Settings: Customizing for Different Markets and Timeframes

While the default settings for the Parabolic SAR (AF = 0.02, Max AF = 0.20) work well in most situations, traders can adjust the acceleration factor to suit different market conditions or trading styles.

– Lower AF (e.g., 0.01): This setting makes the SAR less sensitive to price movements, which may be useful for long-term traders who want to avoid getting stopped out due to minor fluctuations.

– Higher AF (e.g., 0.03 or 0.04): Increasing the AF will make the SAR more responsive to price changes, which is ideal for day traders or scalpers who want to capitalize on short-term price movements.

Customizing the SAR to align with a specific trading strategy or market condition can greatly enhance its effectiveness.

How to Use Parabolic SAR in Trading

The Parabolic SAR is most commonly used for trend-following strategies, but it can also help traders with stop-loss placements and entry and exit signals. Here are several ways to incorporate the SAR into your trading strategy.

-

Trend Identification and Reversal Signals

The primary use of the Parabolic SAR is to identify whether a market is trending up or down. The rule of thumb is simple:

– Buy Signal: If the dots are below the price, it indicates that the market is in an uptrend, signaling a possible buy.

– Sell Signal: If the dots are above the price, it indicates that the market is in a downtrend, signaling a possible sell.

A trader can enter a position in the direction of the trend and hold it as long as the dots remain on the same side of the price. Once the dots flip to the opposite side, it signals a possible trend reversal and suggests that the trader should exit or reverse their position.

- Setting Stop-Losses

One of the key features of the Parabolic SAR is its ability to help traders set trailing stop-losses. As the SAR value moves closer to the current price during a trend, traders can adjust their stop-loss orders accordingly. This allows them to lock in profits while letting the trade run as long as the trend continues.

For example, in an uptrend, a trader could set their stop-loss slightly below the current SAR value. As the trend progresses and the SAR rises, the stop-loss would also be adjusted upwards. This technique ensures that if the price suddenly reverses, the trader’s profits are protected.

-

Avoiding False Signals in Range-Bound Markets

While the Parabolic SAR is effective in trending markets, it tends to produce false signals in sideways or range-bound markets. In these conditions, the price often oscillates between support and resistance levels, causing the SAR dots to flip frequently. This can lead to multiple stop-outs and potential losses.

To counter this issue, traders often combine the Parabolic SAR with other technical indicators such as:

– Moving Averages: To smooth out price data and confirm the overall trend.

– RSI (Relative Strength Index): To identify overbought or oversold conditions, adding another layer of confirmation before taking a position.

– MACD (Moving Average Convergence Divergence): To identify the momentum and trend strength.

By combining the Parabolic SAR with other tools, traders can reduce the likelihood of falling victim to false signals and improve the accuracy of their trades.

Using Parabolic SAR in Forex Trading

The forex market is particularly well-suited to the Parabolic SAR strategy, as currency pairs often exhibit strong, sustained trends. In forex trading, trend-following systems like the Parabolic SAR can help traders time their entries and exits more effectively.

Parabolic SAR with Currency Pairs

Currency pairs such as EUR/USD, GBP/USD, or USD/JPY are popular for trend-following strategies because they tend to have long, clear trends. The Parabolic SAR can help forex traders take advantage of these movements by identifying when to enter a trade and when to exit, ensuring they capture the bulk of the trend while avoiding reversals.

– Enter during a strong trend: If the dots are below the price and the currency pair is in an uptrend, it may be a good time to buy.

– Exit when a reversal is signaled: When the dots flip to the opposite side, signaling a possible trend reversal, traders should consider exiting or tightening their stop-loss to protect their profits.

Parabolic SAR with Intraday Forex Trading

For intraday traders, the Parabolic SAR can help identify trend reversals on shorter timeframes, such as the 5-minute or 15-minute charts. However, the settings for the indicator may need to be adjusted to suit the faster pace of forex trading.

– Smaller AF settings (e.g., 0.01) can reduce noise and avoid frequent stop-outs in choppy markets.

– Larger AF settings (e.g., 0.03) can help traders capture shorter, more immediate trend reversals in volatile currency pairs.

Advantages of Using Parabolic SAR

-

Ease of Use

The Parabolic SAR is easy to understand and interpret. Traders can immediately see the direction of the trend by observing the placement of the dots, making it suitable for beginners and experienced traders alike.

-

Identifies Trend Reversals Early

The Parabolic SAR is designed to catch trend reversals at an early stage, allowing traders to enter or exit positions with better timing. This early indication of a reversal can be a valuable tool for maximizing profit potential.

-

Useful for Setting Dynamic Stop-Losses

One of the key advantages of the Parabolic SAR is its ability to dynamically adjust stop-loss levels as the trade progresses. This allows traders to lock in profits while letting their trades run with minimal risk.

-

Well-Suited for Trending Markets

In strong trending markets, the Parabolic SAR is highly effective at keeping traders on the right side of the trend, preventing them from prematurely exiting their positions.

Disadvantages of Using Parabolic SAR

-

Prone to False Signals in Sideways Markets

The Parabolic SAR can generate many false signals when the market is in a range or consolidating. This can result in multiple stop-outs and whipsaw losses if not used in conjunction with other indicators.

-

Less Effective in Volatile Markets

In highly volatile markets, the Parabolic SAR may give premature signals for trend reversals due to sharp price fluctuations. This can lead to traders exiting trades too early or entering positions during a temporary retracement rather than a true reversal. To counter this, combining the SAR with other indicators, such as moving averages or the Average True Range (ATR), can help filter out noise and reduce the number of false signals.

-

Not Ideal for Long-Term Trading

The Parabolic SAR is best suited for short-term or medium-term trading strategies. Its sensitivity to price changes, especially with the default settings, makes it less effective for long-term positions, where larger trends and cycles come into play. Long-term traders might prefer slower, more robust trend indicators like moving averages or Bollinger Bands for better performance over extended timeframes.

-

Challenges in Choppy Markets

In choppy or consolidating markets, where price action is erratic and lacks a clear trend, the Parabolic SAR often struggles. It may flip frequently between bullish and bearish signals, leading to confusion and multiple losing trades. Traders should be cautious in these market conditions and, where possible, avoid using the SAR until a clear trend emerges.

Optimizing Parabolic SAR for Better Performance

While the Parabolic SAR is effective in trending markets, its performance can be further enhanced by optimizing settings and combining it with other indicators.

-

Adjusting the Acceleration Factor (AF)

By default, the AF is set to 0.02, and the maximum AF is set to 0.20. Adjusting the AF can make the indicator more responsive or less sensitive, depending on the trader’s goals:

– Lower AF (0.01 or less): This reduces sensitivity and helps the indicator stay in line with the price trend for a longer period. It’s useful in avoiding premature exits in longer, smoother trends.

– Higher AF (0.03 or more): Increasing the AF makes the indicator more sensitive, meaning it will respond more quickly to changes in price. This is particularly useful for short-term traders looking to capitalize on fast-moving trends or to exit positions at the earliest sign of a reversal.

-

Combining with Other Indicators

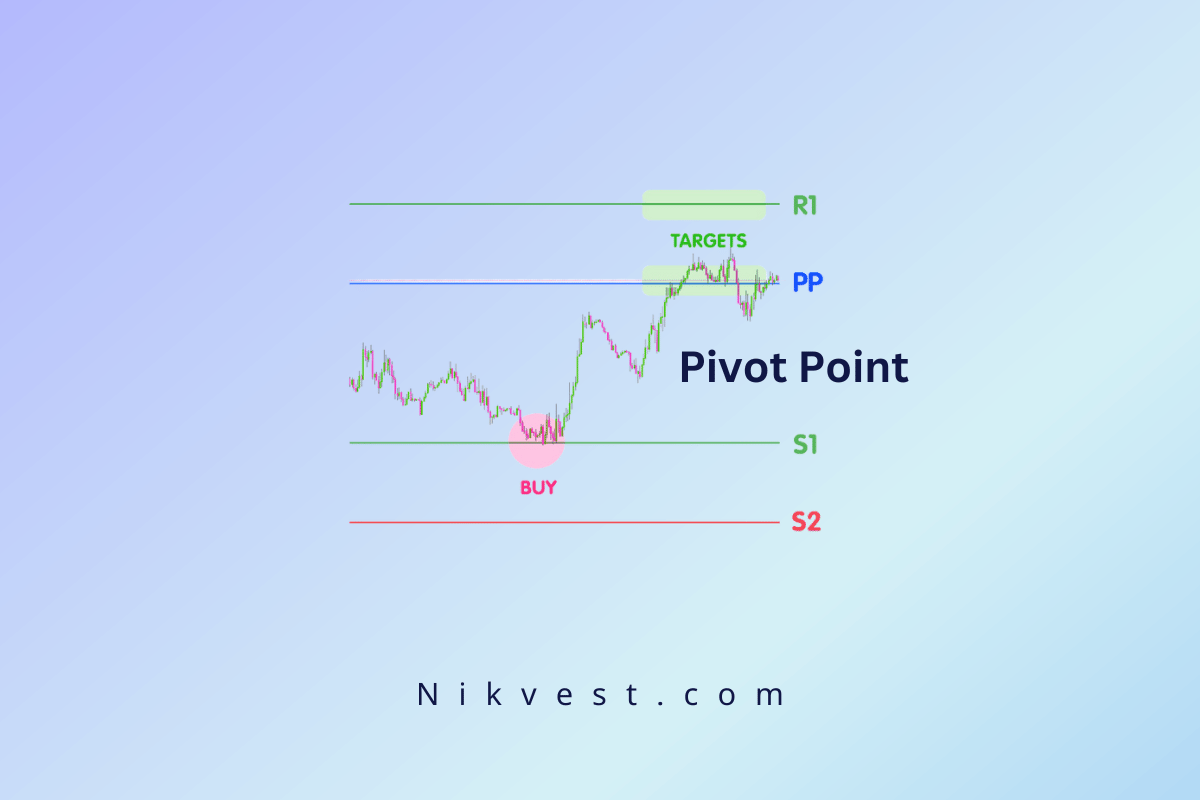

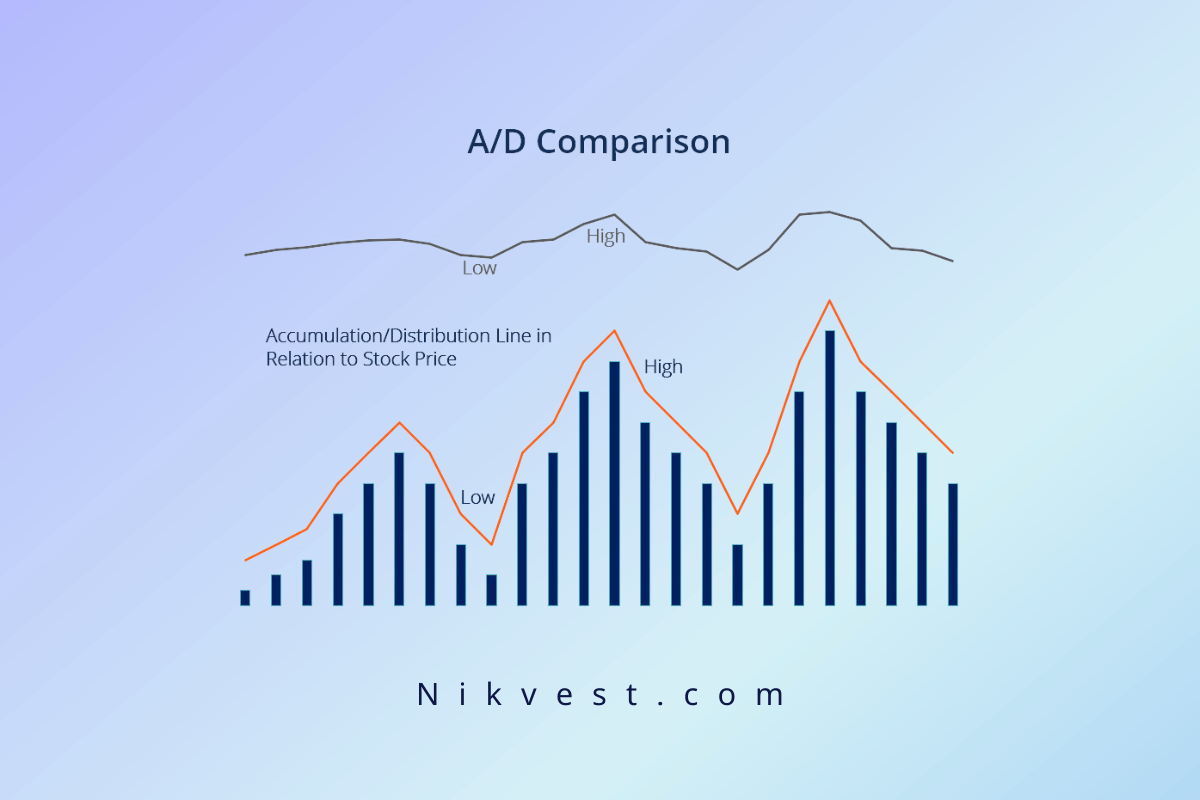

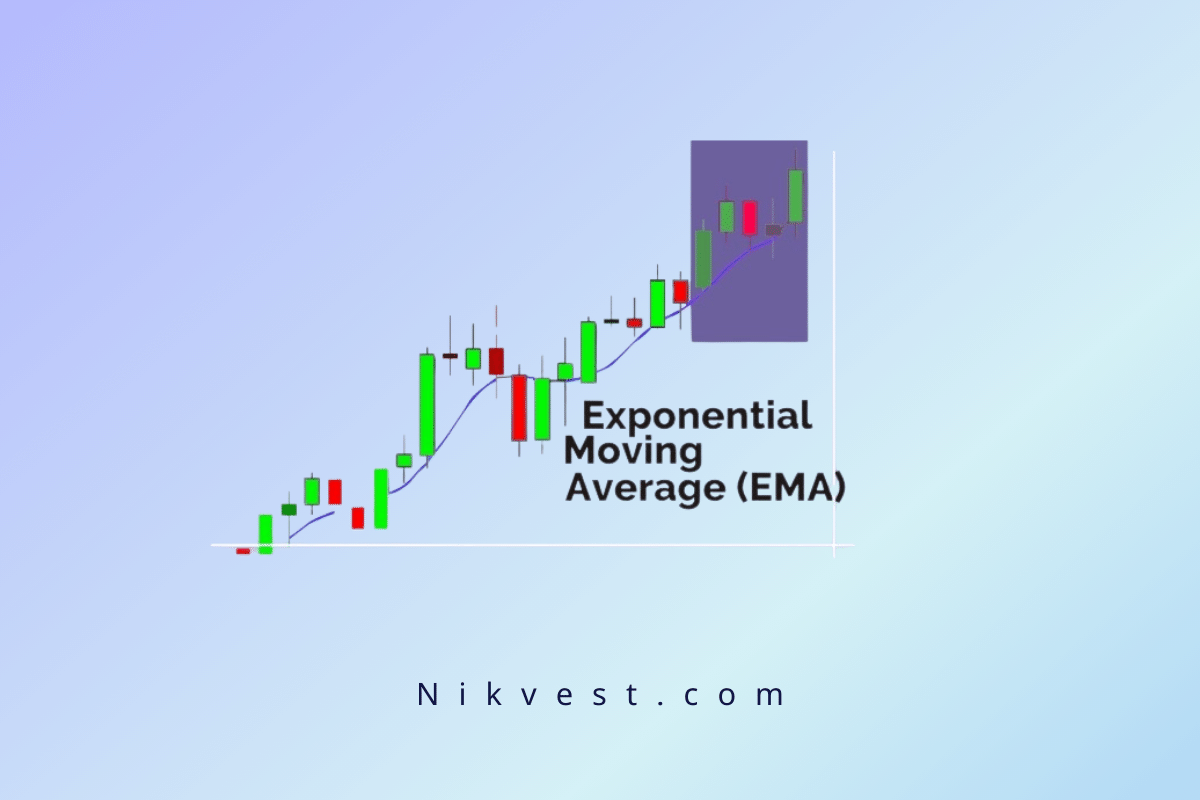

To improve the accuracy of trading decisions, many traders combine the Parabolic SAR with other technical indicators. This can help filter out false signals and confirm trend strength. Some commonly paired indicators include:

– Moving Averages (MA): A simple moving average (SMA) or exponential moving average (EMA) can help confirm the overall trend direction. If both the SAR and moving averages point in the same direction, it strengthens the signal.

– Relative Strength Index (RSI): RSI helps determine whether the market is overbought or oversold. When used in conjunction with SAR, it can help traders avoid entering trades when the price is at extreme levels.

– MACD (Moving Average Convergence Divergence): This momentum indicator can help confirm the strength of a trend. If the MACD aligns with the Parabolic SAR, it adds credibility to the trend signal.

– Bollinger Bands: Bollinger Bands can provide a range in which the price might move, helping traders gauge the volatility and adjust their stop-loss levels.

-

Using Parabolic SAR on Multiple Timeframes

Another method to improve trading with the Parabolic SAR is using multiple timeframes. Traders can apply the SAR on a longer timeframe to determine the overall trend and then switch to a shorter timeframe to fine-tune their entries and exits. For example, if the SAR indicates an uptrend on the daily chart, the trader might look for a pullback or retracement on the 1-hour chart to enter a long position.

Advanced Parabolic SAR Trading Strategies

To maximize the effectiveness of the Parabolic SAR, advanced traders often employ more sophisticated strategies that go beyond the basic buy-and-sell signals. Here are a few advanced techniques:

-

Parabolic SAR with Trendlines

Drawing trendlines can help clarify the overall market structure and provide context for the Parabolic SAR signals. A break of a significant trendline, followed by a flip in the SAR dots, can serve as a powerful confirmation of a trend reversal. For example, if an ascending trendline is broken to the downside, and the SAR dots move above the price, this would strongly indicate that the uptrend is reversing into a downtrend.

-

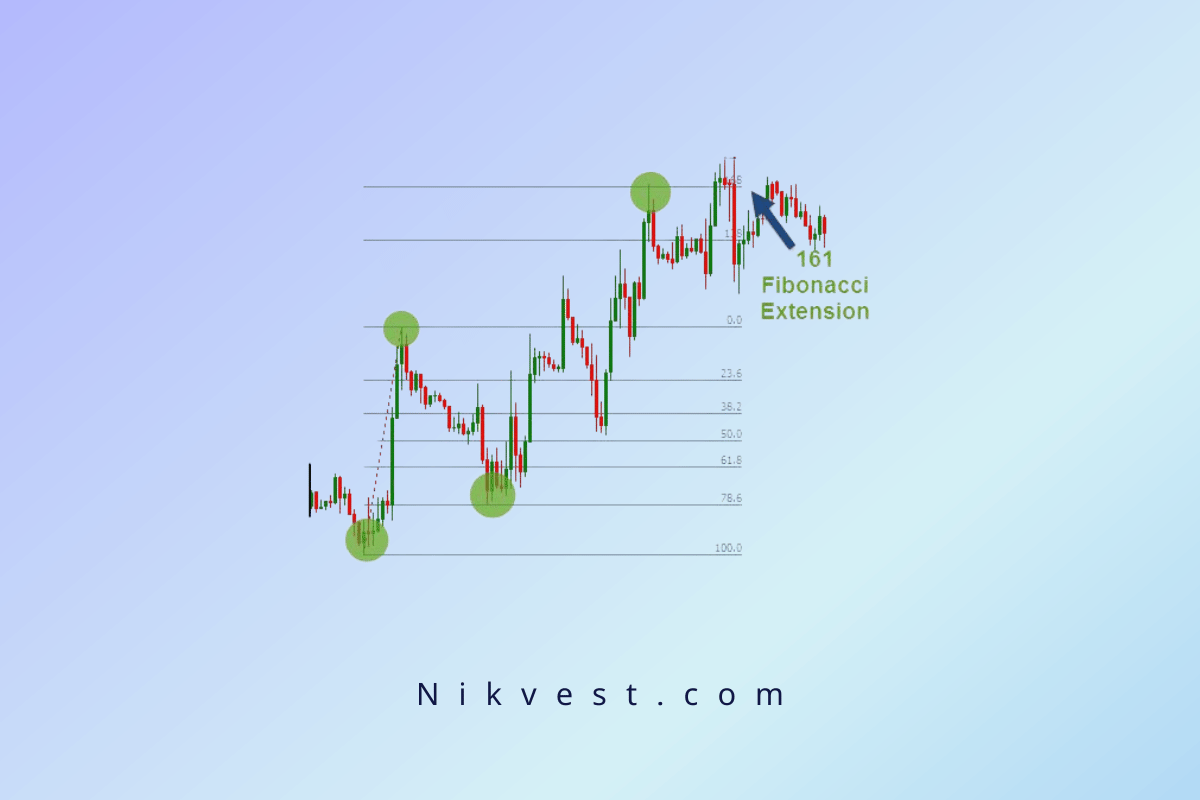

Parabolic SAR with Fibonacci Retracement

Fibonacci retracement levels can be used alongside the Parabolic SAR to identify key levels of support and resistance during a trend. If the SAR indicates an uptrend but the price reaches a significant Fibonacci level (such as the 61.8% retracement), traders might anticipate a pullback or temporary consolidation before the trend resumes. In this case, the Fibonacci level can provide a point for stop-loss placement or profit-taking.

-

Parabolic SAR Breakout Strategy

In trending markets, the Parabolic SAR can be used to capture breakouts. By waiting for the price to consolidate or move in a range, and then using the SAR to signal the breakout direction, traders can enter positions with higher conviction. This strategy works particularly well when combined with volume indicators, as higher trading volume during a breakout can confirm the move’s strength.

-

Trailing Stop Strategy with Parabolic SAR

The Parabolic SAR is commonly used to adjust trailing stop-losses. Traders can adjust their stops to follow the SAR dots as the trend progresses, ensuring they lock in profits while allowing the position to ride the trend. This technique is particularly effective in strong trending markets where the SAR can stay on one side of the price for an extended period.

Parabolic SAR vs. Other Indicators

While the Parabolic SAR is a powerful trend-following tool, it’s worth comparing it with other indicators to understand its strengths and limitations.

-

Parabolic SAR vs. Moving Averages

– Parabolic SAR: Faster at identifying trend reversals but more prone to false signals in choppy markets.

– Moving Averages: Better suited for identifying long-term trends and smoothing out price action. However, moving averages often lag, which may cause delays in capturing reversals.

-

Parabolic SAR vs. Bollinger Bands

– Parabolic SAR: Focuses on trend identification and reversal signals but doesn’t account for volatility.

– Bollinger Bands: Focuses on price volatility, showing periods of high and low volatility, but doesn’t directly provide trend reversal signals. Bollinger Bands can help traders spot overextended price moves, which the Parabolic SAR does not explicitly indicate.

-

Parabolic SAR vs. MACD

– Parabolic SAR: Visual and easy to use for identifying reversals. It’s reactive to price movements but lacks information on momentum.

– MACD: A momentum indicator that helps gauge trend strength and potential divergences. It is less reactive than the SAR but provides more context regarding the underlying strength of a trend.

Final Thoughts on the Parabolic SAR Trend Strategy

The Parabolic SAR is a valuable tool for traders looking to capitalize on trending markets. Its ability to provide clear signals for trend direction and reversal, combined with its effectiveness in setting stop-losses, makes it a popular choice among traders, particularly in forex and stock markets.

However, like any technical indicator, the Parabolic SAR is not without its limitations. Traders should be cautious when using it in sideways or volatile markets, where it can produce false signals. By adjusting its settings and combining it with other technical indicators, traders can enhance its performance and reduce the risk of false signals.

Whether you’re a day trader looking to capture short-term trends or a swing trader aiming to ride larger moves, the Parabolic SAR can be a useful addition to your trading arsenal. Understanding its strengths and weaknesses, as well as learning how to adapt its settings to different market conditions, will help you make better trading decisions and improve your overall profitability.

Enhancing the Parabolic SAR with Risk Management

Effective trading isn’t just about identifying trends or reversals—it’s about managing risk. The Parabolic SAR is an excellent tool for determining trend direction, but no indicator is foolproof. Therefore, incorporating a solid risk management strategy alongside the Parabolic SAR can dramatically improve trading outcomes.

Here are some essential risk management techniques when using the Parabolic SAR:

Position Sizing

Always determine your position size based on the level of risk you’re comfortable with. For instance, many traders follow the 1% rule, which means they never risk more than 1% of their trading capital on a single trade. This is particularly helpful when using the Parabolic SAR, as the indicator can produce signals for multiple trades during strong trends. Proper position sizing ensures that even if some trades result in losses, no single trade will severely impact your account balance.

Trailing Stop-Loss Strategy

The trailing stop-loss is a dynamic method for managing risk and locking in profits during trending markets. The Parabolic SAR naturally lends itself to this strategy. As the price moves in your favor and the SAR dots follow the trend, you can adjust your stop-loss order accordingly. This way, if the trend reverses unexpectedly, your stop-loss will have moved closer to the current price, reducing the size of any potential loss or securing profits.

Risk-Reward Ratio

Before entering a trade, calculate your risk-reward ratio. A good rule of thumb is to target trades where the potential reward is at least twice the amount of risk. For example, if you’re risking $100 on a trade, aim for a reward of at least $200. The Parabolic SAR helps set clear stop-loss points, which simplifies the process of calculating potential risk. Then, based on the trend and market conditions, estimate how far the price could move in your favor to establish a suitable reward target.

Diversification

Relying solely on one indicator like the Parabolic SAR can leave traders exposed to risks associated with specific market conditions (such as choppy or volatile markets). To mitigate this, traders should diversify their strategy. Combining different asset classes (e.g., forex, stocks, commodities) or adding complementary indicators can help reduce the overall risk and improve the quality of trading signals.

Common Mistakes to Avoid When Using Parabolic SAR

The Parabolic SAR can be a highly effective tool, but it’s essential to avoid common pitfalls that can lead to suboptimal trading results. Here are some mistakes that traders often make and how to avoid them:

-

Ignoring Market Context

One of the biggest mistakes traders make is relying on the Parabolic SAR in isolation without considering the broader market context. For example, the SAR might signal a reversal during a strong uptrend, but without confirming this with other indicators (such as moving averages or RSI), the reversal could be temporary or misleading. Always use the SAR in conjunction with other tools to increase the accuracy of your trades.

-

Over-Adjusting Settings

While adjusting the acceleration factor (AF) and other settings can make the SAR more responsive to different market conditions, constantly tweaking these settings can lead to inconsistent results. It’s better to stick with settings that align with your trading style and market conditions, and only adjust them after thorough backtesting. Over-adjusting can cause you to miss out on profitable trades or get caught in false reversals.

-

Not Accounting for Volatility

The SAR is more effective in trending markets but tends to produce false signals in highly volatile or range-bound environments. Many traders mistakenly enter trades during volatile swings, thinking they’re catching a trend reversal, only to get whipsawed by sharp price movements. Be cautious in volatile markets, and consider using additional indicators, like the Bollinger Bands or the Average True Range (ATR), to gauge market volatility before relying solely on the SAR signal.

-

Neglecting Proper Risk Management

Even though the Parabolic SAR provides clear entry and exit points, traders often neglect risk management. Entering trades without a well-thought-out plan for managing losses can lead to significant account drawdowns. Always define your stop-loss levels based on the SAR values and maintain discipline in sticking to them, even when the market is volatile.

Backtesting the Parabolic SAR Strategy

Before implementing the Parabolic SAR strategy in live trading, it’s essential to backtest it on historical price data. Backtesting allows you to see how the SAR would have performed in past market conditions, giving you a better understanding of its strengths and weaknesses. Here’s how to approach backtesting:

-

Historical Data Analysis

Use historical price data of the asset or currency pair you intend to trade. Apply the Parabolic SAR on different timeframes (e.g., daily, hourly, or 15-minute charts) and track how well it signals trend reversals or captures trends. Look for patterns in the SAR’s accuracy and make note of any false signals during sideways or choppy markets.

-

Evaluating Performance Metrics

Key metrics to evaluate during backtesting include:

– Win rate: The percentage of trades that resulted in a profit.

– Average profit per trade: The average amount gained per trade.

– Risk-reward ratio: The overall balance between the risk taken and the reward earned.

– Drawdown: The peak-to-trough decline in your trading account balance.

By analyzing these metrics, you can determine whether the Parabolic SAR strategy is suitable for your trading goals and risk tolerance.

-

Optimizing Settings for Backtesting

During backtesting, test different acceleration factors to see which works best for your chosen asset or timeframe. You might find that the default settings work well in trending markets but need adjustment in more volatile or slower-moving markets.

For example, in fast-moving forex pairs like GBP/JPY, a higher AF setting (e.g., 0.03) might capture trends more effectively. On the other hand, for slower markets like gold or bonds, a lower AF setting might prevent premature exits.

-

Simulated Trading (Paper Trading)

Once backtesting results are satisfactory, consider implementing your strategy in a simulated trading environment (also known as paper trading). This allows you to trade in real-time without risking actual capital, further refining your strategy under live market conditions. During simulated trading, track your performance and note how the Parabolic SAR responds to real-time price movements.

Parabolic SAR in Automated Trading

For traders who prefer to automate their strategies, the Parabolic SAR can be integrated into algorithmic trading systems. By setting predefined rules based on SAR signals, traders can remove emotional decision-making from the equation, ensuring that trades are executed consistently according to the strategy.

-

Building an Automated Strategy

Many trading platforms, such as MetaTrader or TradingView, allow traders to build automated trading bots using technical indicators like the Parabolic SAR. By coding a system that follows the SAR’s buy and sell signals, the bot can enter and exit trades without manual intervention. This can be particularly useful for day traders or scalpers who need to make quick decisions in fast-moving markets.

-

Setting Parameters for Automation

When building an automated strategy, it’s important to define clear rules:

– Entry and Exit Rules: The bot should open a position when the SAR indicates a trend reversal (dots switching from above to below the price, or vice versa) and close the position when the opposite signal occurs.

– Stop-Loss and Take-Profit Rules: Define stop-loss levels based on the current SAR value and take-profit levels based on a risk-reward ratio that suits your trading goals.

– Timeframe Filters: Ensure the bot operates on the desired timeframe (e.g., 5-minute, 1-hour, or daily charts), depending on your trading style.

-

Backtesting and Forward Testing Automated Systems

Before deploying an automated SAR strategy in live markets, thoroughly backtest and forward test the system. Backtesting uses historical data to simulate how the bot would have performed, while forward testing (in a demo account) assesses its performance in live market conditions.

Conclusion: Mastering the Parabolic SAR Trend Strategy

The Parabolic SAR trend strategy is a versatile and powerful tool for traders looking to capture trends and manage risks effectively. Its simplicity, combined with its ability to identify trend reversals, makes it a favorite among both beginner and advanced traders. However, like all technical indicators, it’s not perfect. Understanding its limitations, particularly in volatile and range-bound markets, is key to using it successfully.

By combining the Parabolic SAR with other technical indicators, adjusting settings for different market conditions, and employing solid risk management practices, traders can significantly enhance their trading performance. Whether you’re a short-term trader looking for quick trend reversals or a long-term investor seeking to ride larger market moves, the Parabolic SAR offers valuable insights to help guide your trading decisions.

Ultimately, mastering the Parabolic SAR requires practice, backtesting, and continuous refinement. By staying disciplined and adapting to changing market conditions, you can make the Parabolic SAR a cornerstone of your trend-following strategy.