Imagine a master chef in a bustling kitchen. They don’t just throw ingredients into a pan; they use a precise set of tools—a razor-sharp santoku for slicing, a heavy-duty whisk for emulsifying, a delicate spoon for plating. Each tool has a specific purpose, and using the right one at the right time is the difference between a culinary masterpiece and a disappointing mess.

In the world of forex trading, your orders are your tools. They are the specific instructions you give your broker to enter or exit a trade. Simply clicking “buy” or “sell” is like a chef using a sledgehammer for every task. It might work sometimes, but it lacks precision, control, and finesse. True trading success isn’t just about predicting market direction; it’s about executing your strategy flawlessly, managing risk diligently, and protecting your capital with discipline. Understanding forex order types is the bedrock upon which all these skills are built.

This is not just another glossary of trading terms. This is your complete guide, your trading kitchen manual. We will take you from the most basic “get me in now” market order to the strategic, chess-like placement of complex pending orders. You will learn not just what each order does, but why and when to use it. You will discover how these simple commands are intrinsically linked to risk management, trading psychology, and ultimately, your long-term profitability.

Your Roadmap to Mastering Forex Orders

This comprehensive article is structured into 25 distinct sections, each designed to build upon the last and give you a complete, holistic understanding. Here’s a glimpse of the journey ahead:

- The Foundation: We’ll start with the absolute basics of what forex orders are.

- The Two Pillars: Differentiating between immediate execution and pending orders.

- The Market Order: Your tool for instant entry.

- The Perils of Slippage: The hidden cost of market orders.

- The Limit Order: The art of patience and precision.

- Buy Limit vs. Sell Limit: Strategies for buying low and selling high.

- The Stop Order: Your automated risk manager.

- Buy Stop vs. Sell Stop: The strategy of trading breakouts.

- The Stop-Loss Order: Your non-negotiable insurance policy.

- The Take-Profit Order: The art of securing your gains.

- The Symbiotic Relationship: Combining Stop-Loss and Take-Profit.

- Pending Orders: A Deeper Dive: Becoming a trading architect.

- Trailing Stop Orders: The dynamic profit protector.

- OCO Orders: Betting on both sides of a breakout.

- OTO Orders: The fully automated trade plan.

- Order Duration: Understanding GTC, GFD, and more.

- Fill Policies: A look into FOK vs. IOC.

- The Broker’s Role: What happens behind the scenes.

- The Psychology of Order Placement: Linking orders to emotions.

- Combining Forex Order Types: A practical case study.

- Advanced Stop-Loss Strategies: Moving beyond the basics.

- Order Automation: A glimpse into algorithmic trading.

- Choosing the Right Order: Matching orders to market conditions.

- Common Order Placement Mistakes: And how to fix them.

- Mastering Your Platform: A hands-on guide.

By the end of this guide, you won’t just know the definitions. You will understand the strategic soul of each order type, empowering you to trade with greater confidence, control, and consistency. Let’s begin.

1. The Foundation: What Are Forex Orders?

Imagine walking into your favorite coffee shop. You don’t just hand the barista a ten-dollar bill and say, “Give me coffee.” You give a specific instruction: “I’d like a large, iced vanilla latte with oat milk.” That instruction ensures you get exactly what you want. A forex order is precisely that: a clear, specific instruction given to your broker to execute a trade on your behalf.

At its core, a forex order is a digital message. It’s a command that tells your broker which currency pair you want to trade (e.g., EUR/USD), the direction you want to trade (buy or sell), the amount you want to trade (your position size or lot size), and, most critically, the method of execution. It’s this last part—the method of execution—that defines the different forex order types.

Think of your broker as your personal agent in the vast, trillion-dollar global foreign exchange market. They have the access and the infrastructure to place your trades. Your orders are the way you communicate your intentions to this agent. Without a clear understanding of the language of orders, you’re essentially shouting vague requests into a storm. You might get lucky, but more often than not, you’ll end up with something you didn’t want, at a price you didn’t expect.

Many beginners mistakenly believe that a “trade” and an “order” are the same thing. They are related but distinct.

- An Order is the instruction to do something.

- A Trade (or a Position) is the result of that order being filled or executed.

Mastering the various types of forex orders is your first major step from being a passive market gambler to an active market strategist. It’s the difference between being a passenger on a chaotic bus and being the driver, with your hands firmly on the wheel, in control of your destination. Each order type gives you a different kind of control over price, time, and risk. In the sections that follow, we will dissect each of these powerful tools one by one.

Quick Recap: A forex order is not a trade itself, but the instruction sent to a broker to open, manage, or close a trade. The specific details of that instruction define the order type.

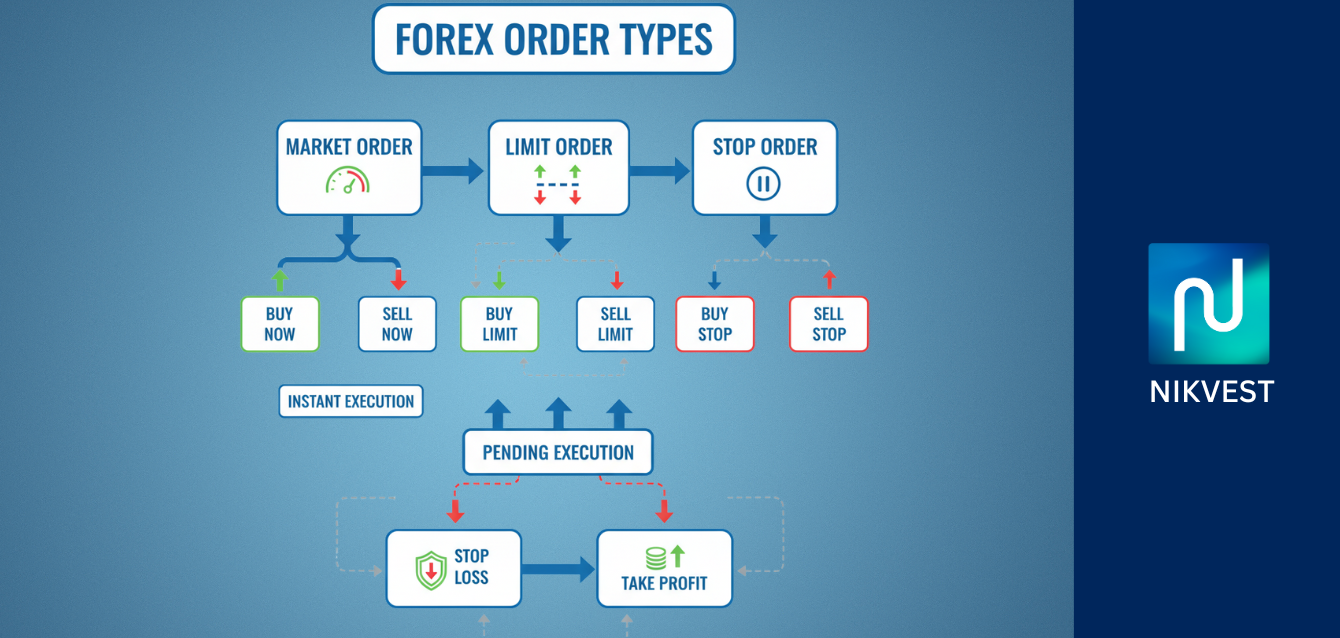

2. The Two Pillars: Market Execution vs. Pending Orders

Did you know that in the modern forex market, a transaction can be executed in under a millisecond? That’s faster than the blink of an eye. This incredible speed is the basis for the first and most fundamental division among all forex order types: the division between immediacy and patience. Every order you will ever place falls into one of two major categories:

- Market Execution Orders: These are the “now” orders. They instruct your broker to execute your trade immediately at the best available price in the market at that exact moment.

- Pending Orders: These are the “when” orders. They are dormant instructions that tell your broker to execute a trade only if and when a specific, predetermined price level is reached in the future.

Think of it like buying a concert ticket. A market order is like going to the box office on the day of the show and saying, “Give me the best available seat, I don’t care the price, I just want in right now.” You are guaranteed a ticket (execution), but the price and seat location might not be what you hoped for.

A pending order is like setting a price alert online: “Email me if and when tickets in the front row drop below $100.” You are not buying immediately. You are setting a condition, and the transaction will only happen if that condition is met. control the price, but there’s no guarantee the condition will ever be met, so you might not get a ticket at all.

This fundamental difference is crucial for your trading strategy and psychology. Market orders are for traders who prioritize speed and guaranteed entry over price precision. They are often used in fast-moving markets or when a trader believes a significant move is happening right now. Pending orders are for traders who prioritize price and planning. They analyze the market, determine their ideal entry or exit points in advance, and then set orders to do the work for them, freeing them from being glued to the screen.

Comparison Table: Market Execution vs. Pending Orders

Understanding this core distinction is the first step. Every other specific order type we discuss—Limit, Stop, Stop-Loss, etc.—is simply a variation of one of these two pillars. Mastering the various types of forex orders begins with knowing whether you need to act now or wait for the right moment.

3. The Market Order: Your ‘Get Me In Now’ Button

The scene is tense. The U.S. Federal Reserve has just made a surprise announcement, cutting interest rates unexpectedly. On your screen, the EUR/USD chart, which had been moving sideways, suddenly explodes upwards. A massive green candle is forming, and every tick seems to be higher than the last. You feel that jolt of adrenaline, the fear of missing out (FOMO) creeping in. You believe the pair is heading for the moon, and you need to be on that rocket now. This is the classic scenario for a market order.

A Market Order is the simplest and most straightforward of all forex order types. It is a direct command to your broker: “Buy or sell this currency pair for me immediately at the best price currently available.”

When you place a market order, you are prioritizing speed above all else. You aren’t specifying a price. You are accepting whatever price the market is willing to give you at the instant your order is processed. In a liquid market like forex, this is usually very close to the price you see on your screen.

The Pros of a Market Order:

- Instant Gratification & Guaranteed Execution: This is its main appeal. If you want to be in a trade, a market order is the most reliable way to get in. In 99.9% of normal market conditions, your order will be filled.

- Simplicity: There are no extra parameters to set. You just choose your direction (buy/sell) and size, and click the button. This makes it very appealing for absolute beginners.

The Cons of a Market Order:

- Lack of Price Control: You are at the mercy of the market. You get the next available price, not necessarily the price you wanted.

- Slippage: This is the most significant risk. Slippage is the difference between the price you expected when you clicked the button and the price at which you were actually filled. In fast-moving markets, like our news announcement scenario, this difference can be substantial and work against you. We’ll dedicate the next section entirely to this critical concept.

A market order is like jumping onto a moving train. You’ll definitely get on, but you might stumble and land a few feet from where you intended. It’s a powerful tool when you need it, but using it indiscriminately is a hallmark of an impulsive, amateur trader.

Mistake to Avoid Never use a market order during periods of extreme, known volatility, such as major news releases (like Non-Farm Payrolls) or during the market open on a Monday. During these times, liquidity is thin, and the bid-ask spread widens dramatically. A market order is an open invitation for severe slippage, which can instantly put your trade at a significant disadvantage. In these scenarios, a more precise tool is required.

4. The Perils of Slippage with Market Orders

“What on earth happened?!” Alex muttered, staring at his screen in disbelief. “I saw EUR/USD at 1.0750, I hit ‘Buy’, and my platform filled me at 1.0753! I was down 3 pips before the trade even had a chance to breathe!”

This feeling of frustration is one every new trader using market orders experiences. This phenomenon, this phantom cost that appears between your click and your trade’s execution, is called slippage. Understanding it is non-negotiable if you want to protect your capital.

Slippage, in simple terms, is the difference between the expected price of a trade and the price at which the trade is actually executed. It can be positive, negative, or zero.

- Negative Slippage: This is the most common kind. Your buy order is filled at a higher price, or your sell order is filled at a lower price than you saw. This is what happened to Alex.

- Positive Slippage: This is rare but possible. Your buy order is filled at a lower price, or your sell order is filled at a higher price. It’s a pleasant surprise.

- Zero Slippage: You are filled at the exact price you saw on the screen.

So, why does slippage happen?

It’s not your broker trying to cheat you (usually). It’s a natural function of how markets work, driven by two factors: market speed and liquidity.

- Market Speed: The forex market moves at lightning speed. The price quotes you see on your screen are changing constantly. There’s a tiny delay (latency) between you clicking the button, your order traveling over the internet to your broker’s server, and the server executing it. In that fraction of a second, the price can change. In a calm market, it might not change at all. In a volatile market after a news release, it can change dramatically.

- Liquidity (Order Book Depth): Imagine the price of EUR/USD is 1.0750. That price is supported by a certain volume of orders. Let’s say there are $5 million worth of sell orders available at 1.0750. If you place a small buy order of $10,000, you’ll likely get filled at 1.0750. But what if you (or many traders at once) place a large buy order for $10 million? The first $5 million of your order will be filled at 1.0750. The market then has to find the next available sell orders to fill the rest of your position. Those might be at 1.0751, 1.0752, etc. Your average fill price will be higher than the 1.0750 you initially saw. This is slippage caused by a lack of sufficient liquidity at a single price point.

Market orders are the most susceptible to this because they essentially tell the broker, “I don’t care about the price, just fill me.” This makes them particularly dangerous during low-liquidity periods (like weekends or bank holidays) or high-volatility periods when the order book is thin and prices are jumping around. Slippage is a hidden transaction cost that can erode your profits over time. Acknowledging its existence is the first step toward using more advanced forex order typesto combat it.

5. The Limit Order – Precision and Patience Personified

There’s a pervasive myth in the trading world that to be successful, you must be chained to your desk, eyes bloodshot, watching every single tick of the market, ready to pounce. This “screen warrior” mentality leads to burnout, emotional decisions, and sloppy trading. But what if there was a way to trade your plan with precision, without having to watch the market 24/5?

This is the power of the Limit Order. This is where you evolve from a reactive market participant into a proactive trading strategist.

A Limit Order is a type of pending order that instructs your broker to buy or sell a currency pair at a specific price or better. The key phrase here is “or better.” This is what fundamentally distinguishes it from other types of forex orders.

- For a Buy Limit order, you set your desired price below the current market price. Your order will only be executed if the market price drops to your specified level (or even lower, giving you a better deal).

- For a Sell Limit order, you set your desired price above the current market price. Your order will only be executed if the market price rises to your specified level (or even higher, giving you a better deal).

Let’s break that down with an analogy. You want to buy a specific model of a new smartphone. The current retail price is $1,000. You think that’s too expensive and believe it will go on sale soon. You decide you are only willing to buy it if the price drops to $900. A limit order is like telling the store, “Call me and sell me this phone only if the price hits $900.”

You don’t sit in the store all day waiting. You set your condition and go about your life. If the price never drops to $900, you never buy the phone (no execution). If it does drop to $900, your order is filled, and you get the phone at the price you wanted. it gaps down and opens at $890, you get it for even cheaper—that’s the “or better” part.

The primary advantage of a limit order is price control. You eliminate negative slippage. You guarantee that you will not pay more than you want for a buy, or receive less than you want for a sell. This allows you to plan your trades with incredible precision based on your technical analysis of support and resistance levels. The trade-off, of course, is that execution is not guaranteed. The market may never reach your price, and you could miss out on a move. But this is a trade-off that disciplined, patient traders are happy to make.

6. Buy Limit vs. Sell Limit – A Tale of Two Strategies

Mentor: “Alright, Sarah, you’ve identified a key support level on the GBP/USD chart at 1.2500. The price is currently trading at 1.2550. You believe the price will dip down to that support level and then bounce back up. How would you enter this trade?”

Sarah: “Well, I could watch it like a hawk and hit ‘buy’ with a market order the second it touches 1.2500.”

Mentor: “You could. But what if you have to step away? What if it touches that level while you’re asleep? And what if the price moves so fast that you get filled with slippage at 1.2505? You’re already starting the trade at a disadvantage. There’s a better, more professional way.”

Sarah: “A limit order?”

Mentor: “Exactly. But which kind?”

This dialogue highlights the practical application of the two types of limit orders. They are not just abstract concepts; they are the direct execution tools for two of the most common trading strategies: buying dips in an uptrend and selling rallies in a downtrend.

The Buy Limit Order: The “Buy the Dip” Tool

A Buy Limit is placed below the current market price. It is used when a trader anticipates that the price of an asset will fall to a certain level and then rebound higher.

- Scenario: EUR/USD is in a clear uptrend but is currently in a minor pullback. It’s trading at 1.0880. Your analysis shows a strong support level (perhaps a previous low or a key Fibonacci level) at 1.0850.

- Strategy: You believe the price will drop to 1.0850, attract buyers at that support level, and then continue its uptrend.

- Execution: You place a Buy Limit order at 1.0850. You can now walk away from your screen. If and when the market drops to 1.0850, your buy order is automatically triggered. You have entered the market at your pre-planned, advantageous price point.

The Sell Limit Order: The “Sell the Rally” Tool

A Sell Limit is placed above the current market price. It is used when a trader anticipates that the price of an asset will rise to a certain level and then fall back down.

- Scenario: USD/JPY is in a clear downtrend but is currently in a minor corrective rally. It’s trading at 145.20. Your analysis identifies a strong resistance level (perhaps a previous high or a trendline) at 145.60.

- Strategy: You believe the price will rally up to 145.60, hit that resistance ceiling, and then resume its overall downtrend.

- Execution: You place a Sell Limit order at 145.60. If the market rallies to that level, your sell (short) order is triggered, positioning you perfectly to profit from the expected move back down.

Trader Insight There is an immense psychological benefit to using limit orders. Instead of chasing the market, you are making the market come to you. This simple shift in perspective moves you from a state of anxiety and FOMO to a state of calm, calculated patience. You define your terms of engagement with the market. If the market meets your terms, you trade. If it doesn’t, you don’t. This level of discipline, facilitated by the correct use of these forex order types, is a cornerstone of professional trading.

7. The Stop Order – Your Automated Risk Manager

It was a nightmare scenario. A young trader, Mark, had just bought into what he thought was a promising uptrend in the AUD/USD. He placed his trade and then had to leave for a family dinner, feeling confident. He didn’t set a protective stop. While he was away, an unexpected geopolitical event sent the Australian dollar into a freefall. When Mark returned a few hours later, he found his account decimated. A trade that should have been a small, manageable loss had turned into a catastrophic blow-out.

This painful story, which is all too common for beginners, could have been entirely prevented with one simple tool: the Stop Order.

While we often think of orders as tools to enter a market, some of the most critical types of forex orders are designed to exit a market. A Stop Order is a pending order to buy or sell a currency pair once the price reaches a specific, pre-defined point that is worse than the current market price.

Wait, “worse”? Why would you want to trade at a worse price? The answer lies in two very different applications: defensive risk management and offensive breakout trading. In this section, we’ll focus on the defensive aspect. The most crucial use of a stop order is the Stop-Loss, which we’ll dedicate an entire section to later. For now, let’s understand the core mechanic.

A stop order is your automated line in the sand. It’s an instruction to your broker that says, “If the market moves against me and reaches this specific price point, I admit I was wrong on this trade. Close my position immediately to prevent any further losses.”

Let’s say you buy EUR/USD at 1.0800, expecting it to go up. You decide that the maximum you are willing to lose on this trade is 50 pips. You would place a Stop Order to sell at 1.0750.

- If the price goes up as you expect, the stop order does nothing.

- If the price starts to fall, the stop order lies dormant.

- If the price touches 1.0750, your stop order is triggered. It instantly becomes a market order to sell, and your position is closed, limiting your loss to approximately 50 pips.

It’s crucial to understand that when a stop order’s price level is hit, it becomes a market order. This means it is subject to slippage, just like a regular market order. In a very fast-moving market, your stop at 1.0750 might get filled at 1.0749 or 1.0748. Despite this, it is an indispensable tool. A small amount of slippage on a controlled loss is infinitely better than an uncontrolled, account-destroying loss like Mark’s. The stop order is the seatbelt of your trading car. You hope you never need it, but you should never, ever trade without it.

8. Buy Stop vs. Sell Stop – Trading the Breakout

“The trend is your friend.” It’s one of the oldest adages in trading. But how do you join a trend that’s already in motion? If you just jump in with a market order, you might be buying at the very top of a move right before a pullback. This is where stop orders show their offensive, trend-following power.

While limit orders are used to trade reversals (buying dips, selling rallies), stop orders used for entry are designed to trade continuations or breakouts. They are for traders who believe that if a certain price level is broken, the momentum will carry the price much further in that same direction.

The Buy Stop Order: Betting on a Breakout to the Upside

A Buy Stop order is placed above the current market price. It is an instruction to buy only if the price rises to your specified level. This might seem counterintuitive—why would you want to buy at a higher price?

- Scenario: The USD/CAD is trading at 1.3620, but it is stuck below a very strong resistance level at 1.3650. It has tested this level several times but has failed to break through.

- Strategy: Your analysis suggests that if the price can finally break above 1.3650, it will trigger a flood of new buying interest and a surge in momentum, sending the price much higher. You don’t want to buy before the breakout, because it might fail again. You want to buy as the breakout is confirmed.

- Execution: You place a Buy Stop order at 1.3655, just a few pips above the resistance level. If the price continues to languish below 1.3650, your order does nothing. But if a strong surge of buying pressure pushes the price through 1.3650 and up to 1.3655, your buy order is triggered, and you are now in a long position, perfectly positioned to ride the new wave of upward momentum.

The Sell Stop Order: Betting on a Breakdown to the Downside

A Sell Stop order is placed below the current market price. It is an instruction to sell only if the price falls to your specified level.

- Scenario: The stock index S&P 500 (often traded as a CFD in forex platforms) is trading at 5120. It is holding above a critical support level at 5100.

- Strategy: You believe that as long as the price stays above 5100, the market is stable. However, if that support level breaks, it will trigger fear and a wave of panic selling, causing a sharp drop.

- Execution: You place a Sell Stop order at 5095, just below the support level. If the index bounces off the support and heads higher, your order is never touched. But if the sellers take control and push the price down through 5100 to 5095, your sell order is activated, putting you in a short position to profit from the anticipated decline.

These pending orders are the primary tools of breakout and momentum traders. They allow a trader to enter the market only when the price demonstrates a significant confirmation of strength or weakness, helping to filter out false moves and noise within a trading range.

9. The Stop-Loss Order – The Most Important Order You’ll Ever Place

This isn’t just another one of the forex order types. This isn’t an optional extra or a fancy technique for advanced traders. The Stop-Loss Order is your trading career’s insurance policy. It is the single most important command you will ever give your broker. It is the dividing line between professional risk management and amateur gambling.

A Stop-Loss Order (S/L) is a defensive stop order attached to an open trade. Its sole purpose is to limit your potential loss on that specific position. It automatically closes your trade if the market moves against you by a specified amount.

Let’s be brutally honest: you will have losing trades. Every single professional trader in the world has losing trades. George Soros has losing trades. Warren Buffett has losing trades. The difference between a professional and a gambler is not that the professional is always right. The difference is that when the professional is wrong, they lose a small, pre-defined, and manageable amount. The gambler, on the other hand, lets a small mistake turn into a financial catastrophe.

How a Stop-Loss Works:

- If you have a Buy (Long) Position: Your Stop-Loss will be a sell order placed below your entry price.

- If you have a Sell (Short) Position: Your Stop-Loss will be a buy order placed above your entry price.

Example: You buy 1 mini lot of EUR/USD at 1.0800. You decide you are willing to risk a maximum of $50 on this trade. This corresponds to a 50-pip move against you. You immediately place a Stop-Loss order at 1.0750.

Now, one of two things can happen:

- The price moves up to 1.0900. Your trade is profitable, and the Stop-Loss has not been triggered.

- The price moves down and hits 1.0750. Your Stop-Loss order is triggered, it becomes a market order to sell, and your position is closed. You have lost approximately $50. The damage has been contained. You live to trade another day.

Without that Stop-Loss, a move down to 1.0700 would be a $100 loss. A move to 1.0600 would be a $200 loss. The Stop-Loss is the mechanism that enforces your discipline when your emotions (like hope or fear) might tempt you to hold onto a losing trade “just in case it turns around.”

⚡ Pro Tip: Set Your Stop-Loss Immediately The moment you enter a trade, your very next action should be to set your Stop-Loss. Don’t wait. Don’t say, “I’ll see how the price moves first.” In the seconds it takes you to hesitate, a flash crash or a sudden news spike could occur. Setting your Stop-Loss should be an inseparable part of the trade entry process. It’s not a suggestion; it’s a rule. Mastering risk management in forex begins and ends with the disciplined use of the Stop-Loss order.

10. The Take-Profit Order – Locking in Your Gains

“My trade was up 100 pips! I was so happy. My figured it would go even higher, maybe 200 pips. I went to make some lunch, came back an hour later, and the market had completely reversed. My trade was now at breakeven. Greed turned my winning trade into nothing.”

This is the other side of the emotional coin in trading. If the Stop-Loss order is your defense against fear and hope on a losing trade, the Take-Profit Order is your defense against greed on a winning trade.

A Take-Profit Order (T/P) is a type of limit order that is attached to an open trade. Its purpose is to automatically close your position once it reaches a specific level of profit. It “locks in” your gains.

Just like a Stop-Loss, it’s a pre-planned exit strategy. It removes the emotional burden of deciding when to exit a profitable trade. When a trade is going well, the temptation to squeeze every last pip out of it can be overwhelming. This greed often leads traders to hold on for too long, only to watch the market reverse and eat away their hard-earned paper profits.

How a Take-Profit Works:

- If you have a Buy (Long) Position: Your Take-Profit will be a sell limit order placed above your entry price.

- If you have a Sell (Short) Position: Your Take-Profit will be a buy limit order placed below your entry price.

Example: You buy 1 mini lot of EUR/USD at 1.0800. You have a profit target of 100 pips, which corresponds to a $100 profit. You place a Take-Profit order at 1.0900.

- The price rallies and touches 1.0900. Your Take-Profit order is triggered. Your position is closed automatically, and the $100 profit is credited to your account balance.

- The price might continue to rally to 1.0950 after you’ve been taken out. That’s okay. You stuck to your plan. As the old trading saying goes, “Nobody ever went broke taking a profit.”

A Take-Profit order forces you to be systematic. It ensures that you actually realize your profits instead of just watching them appear and disappear on your screen. It is an essential component of a complete trading plan and a critical part of the family of types of forex orders that every beginner must master.

11. The Symbiotic Relationship: Stop-Loss and Take-Profit

Imagine you’re driving a high-performance race car. The accelerator is your potential for profit—it’s what makes the car go forward. The Stop-Loss is your brake pedal—your essential safety device. The Take-Profit is your GPS destination—it’s the point where you’ve decided your journey ends successfully. You need all three to operate the car effectively and safely.

The Stop-Loss (S/L) and Take-Profit (T/P) orders are not isolated tools. They exist in a symbiotic, inseparable relationship. When you place a trade, you should ideally define both of them at the same time. Together, they achieve something incredibly powerful: they define your Risk-to-Reward Ratio (R/R) for the trade before you even enter it.

The Risk-to-Reward Ratio is a simple calculation that compares the amount of money you are risking to the amount of potential profit you are trying to make.

Let’s put it into a practical example:

You decide to buy AUD/USD at 0.6600.

- You analyze the chart and place your Stop-Loss at 0.6550. Your risk is 50 pips.

- You identify the next major resistance level and place your Take-Profit at 0.6700. Your potential reward is 100 pips.

Your Risk/Reward Ratio is 50 pips / 100 pips = 1:2.

This means you are risking $1 for the potential to make $2. This is a positive or “favorable” R/R ratio.

Why is this so important?

Because it means you don’t have to be right all the time to be profitable! Let’s say you take 10 trades with this exact 1:2 R/R ratio.

- You lose 6 trades: 6 x (-50 pips) = -300 pips

- You win 4 trades: 4 x (+100 pips) = +400 pips

Even though you were only right 40% of the time, your net result is a profit of 100 pips. This is the mathematical edge that professional traders live by. It is impossible to achieve this without the disciplined, simultaneous use of Stop-Loss and Take-Profit orders.

By setting both S/L and T/P when you initiate a trade, you transform trading from a guessing game into a strategic business. You have a clearly defined plan for both potential outcomes (profit or loss). This removes emotion and in-the-moment decision-making, which are the enemies of consistent trading. Mastering these fundamental forex order types is the first step in building a robust system for risk management in forex.

12. Pending Orders: A Deeper Dive

Let’s return to the concept of being a trading architect. An architect doesn’t show up at a construction site with a pile of bricks and start building randomly. They spend weeks or months meticulously designing blueprints. They define every angle, every support beam, every entry and exit point of the building long before the first shovel hits the ground.

Pending Orders allow you to be that architect for your trades. They are the tools you use to draw your trading blueprints directly onto the price chart. We’ve already met the four main types, but let’s consolidate our knowledge and compare them side-by-side to fully appreciate their strategic differences.

The entire family of pending orders can be broken down based on two questions:

- Where do you want to enter relative to the current price? (Above or Below)

- What do you expect the price to do when it gets there? (Reverse or Continue/Breakout)

Let’s map this out:

- You want to enter BELOW the current price…

- …and you expect the price to REVERSE and go up. You use a BUY LIMIT.

- …and you expect the price to CONTINUE breaking down. You use a SELL STOP.

- You want to enter ABOVE the current price…

- …and you expect the price to REVERSE and go down. You use a SELL LIMIT.

- …and you expect the price to CONTINUE breaking out. You use a BUY STOP.

This simple framework is one of the most powerful mental models in this beginner forex trading guide.

Comparison Table: The Four Main Pending Order Types

The “set and forget” nature of these orders is their greatest strength. It allows you to analyze the market when you are calm and objective, set your orders based on that rational analysis, and then let the market do the work. It prevents you from second-guessing yourself or making impulsive decisions based on short-term market noise. A trader who masters the full suite of these pending orders is a trader who is in control of their strategy, not a slave to the screen.

13. Trailing Stop Orders – The Dynamic Profit Protector

You’re in a great trade. You bought EUR/USD, and it’s rallied 150 pips in your favor. Your Take-Profit order is still another 100 pips away. The trend looks strong, but you’re getting nervous. What if it reverses now? Should you close the trade and take your 150 pips? But what if it keeps going and you miss out on another 100 pips? This dilemma is known as “managing a winning trade,” and it can be just as stressful as managing a loser.

Enter the Trailing Stop Order. This is a more advanced and dynamic type of stop-loss that ingeniously solves this problem.

A Trailing Stop is a stop-loss order that automatically “trails” or follows the market price as it moves in your favor. It’s designed to lock in profits while still giving your trade room to grow.

You set a Trailing Stop at a specific distance (in pips or percentage) away from the current market price.

- For a Buy (Long) Position: As the price moves up, the Trailing Stop moves up with it, always maintaining the specified distance. If the price starts to fall, the Trailing Stop stays put. It never moves down. If the price then falls far enough to hit the Trailing Stop’s fixed level, the trade is closed.

- For a Sell (Short) Position: As the price moves down, the Trailing Stop moves down with it. If the price starts to rise, the Trailing Stop stays put. It never moves up.

Let’s illustrate with an example:

- You buy GBP/USD at 1.2500.

- You set a Trailing Stop with a distance of 50 pips. Initially, this places your effective Stop-Loss at 1.2450.

- The market rallies to 1.2550. Your Trailing Stop automatically moves up to 1.2500 (your entry price). Your trade is now “risk-free” because the worst-case scenario is breaking even.

- The market continues to rally to 1.2600. Your Trailing Stop follows it up to 1.2550. You have now locked in 50 pips of profit.

- The market then pulls back and drops to 1.2550. Your Trailing Stop is triggered, and your trade is closed for a 50-pip profit.

Without the Trailing Stop, you might have panicked and closed at 1.2550 manually, or held on and watched the entire profit evaporate. The Trailing Stop automates the process of letting your profits run while still protecting your downside. It’s a fantastic tool for trend-following strategies in markets that are making strong, sustained moves.

A Word of Caution: The main challenge is setting the right trailing distance. If it’s too tight (e.g., 15 pips), a normal, minor market pullback can stop you out of a good trade prematurely. If it’s too wide (e.g., 150 pips), you risk giving back a large portion of your profits before it triggers. Finding the optimal distance often involves analyzing a currency pair’s volatility, perhaps using a tool like the Average True Range (ATR) indicator.

14. OCO Orders (One-Cancels-the-Other) – Betting on Both Sides of a Breakout

Did you know that some of the biggest market moves happen in the minutes surrounding a major economic data release, like the U.S. Non-Farm Payrolls (NFP) report? The price can explode 100 pips in one direction… or the other. For traders, this is a moment of great opportunity and great peril. The volatility is huge, but the direction is unknown beforehand. How can you position yourself to profit from a massive move, regardless of which way it goes?

This is the strategic puzzle that the OCO (One-Cancels-the-Other) order is designed to solve. An OCO order is a sophisticated combination of two pending orders. The “magic” is right in the name: when one of the orders is triggered and executed, the other one is automatically cancelled.

The most common use for an OCO order is the “breakout strategy” around a key event or a period of tight consolidation.

The NFP Scenario: Let’s say EUR/USD is trading in a tight 30-pip range at 1.0850 just before the NFP announcement. The market is holding its breath.

- Resistance is at 1.0865.

- Support is at 1.0835.

You believe the NFP data will cause the price to break out of this range violently, but you don’t know if the news will be good or bad for the US dollar.

Your OCO Strategy: You place an OCO order that consists of two separate entry orders:

- A Buy Stop order at 1.0870 (just above the resistance).

- A Sell Stop order at 1.0830 (just below the support).

Now, let’s see what happens when the news is released:

- Outcome A: The news is positive for EUR. The price rockets upwards. It blows through 1.0865 and hits your Buy Stop at 1.0870. This order is executed, and you are now in a long trade, riding the momentum up. The instant this happens, your Sell Stop order at 1.0830 is automatically cancelled by the platform.

- Outcome B: The news is negative for EUR. The price plummets downwards. It breaks through 1.0835 and hits your Sell Stop at 1.0830. This order is executed, and you are now in a short trade, profiting from the move down. The moment it’s filled, your Buy Stop order at 1.0870 is automatically cancelled.

The OCO order allows you to bracket the market, setting your traps above and below the current price, ready to spring into action no matter which direction the breakout occurs. It’s a powerful, advanced strategy that requires a good understanding of forex order types and market dynamics. Not all brokers offer OCO orders directly, but the logic can often be replicated with scripts or expert advisors on platforms like MetaTrader.

15. OTO Orders (One-Triggers-the-Other) – The Automated Trade Plan

Trader A: “Okay, my Buy Limit on USD/CHF just got filled. Quick, now I need to calculate my stop-loss level… okay, got it. Now, where’s my take-profit target… let me find that resistance line… okay, now I’ll place those two orders. Phew. Done.”

Trader B: “My Buy Limit on USD/CHF just got filled. My pre-set stop-loss and take-profit orders were placed automatically at the same instant. I’m already protected and have my target set. I’m going to get some coffee.”

The difference between these two traders is efficiency, discipline, and the smart use of an OTO (One-Triggers-the-Other) order. While an OCO order involves two entry orders, an OTO order is a sequence where one primary order triggers one or more secondary orders.

Most commonly, an OTO order links a pending entry order (like a Buy Limit or Buy Stop) to its corresponding Stop-Loss and Take-Profit orders. This creates a complete, automated trading plan in a single package.

How it works: You decide on your entire trade plan in advance:

- Entry: You want to buy EUR/JPY if it pulls back to a support level of 162.50. (This will be a Buy Limit order).

- Stop-Loss: If your entry is filled, you want your stop-loss placed 50 pips below at 162.00.

- Take-Profit: If your entry is filled, you want your take-profit placed 150 pips above at 164.00.

Using an OTO order function, you place all three of these instructions at once.

- Initially, only the Buy Limit order at 162.50 is active in the market. The S/L and T/P orders are dormant, held on the broker’s server.

- If the market never drops to 1.250, nothing happens. The entire plan is moot.

- However, if the market does drop and your Buy Limit at 162.50 is executed, this event acts as the trigger.

- The instant your entry order is filled, the system automatically places your Stop-Loss at 162.00 and your Take-Profit at 164.00 to manage the now-live position.

The benefits of this are immense:

- Discipline: It forces you to define your risk and reward before you enter the trade, preventing emotional decisions in the heat of the moment.

- Speed & Reliability: There is zero delay between your entry and your protective orders being placed. This is crucial in fast markets where the price could move against you in seconds.

- Convenience: It is the pinnacle of “set and forget” trading. You can plan dozens of such setups across various currency pairs and let the market come to you, knowing that if any trade is triggered, it will be fully managed from the start.

Many modern trading platforms have this functionality built directly into their standard order interface, sometimes called a “Bracket Order.” It’s one of the most powerful and professional types of forex orders a trader can use.

16. Order Duration – GTC, GFD, and More

Trader: “My pending order on gold disappeared overnight! I had a perfect Sell Limit set at a key resistance level, and the price hit it this morning, but my order was gone. What happened? Did my broker just delete it?”

This common point of confusion for new traders often has nothing to do with the broker and everything to do with a small, often overlooked setting in the order window: the order duration or time-in-force.

A time-in-force instruction specifies how long your pending order will remain active in the market before it is cancelled if it’s not filled. It’s like putting an expiration date on your instruction. Not all forex order types have this, as market orders are executed instantly. This primarily applies to pending orders like limits and stops.

Here are the most common duration types you’ll encounter:

1. GTC (Good ‘Til Cancelled) This is usually the default setting on most retail trading platforms. A GTC order will remain active indefinitely until one of two things happens:

- The order is filled (i.e., the price reaches your specified level).

- You manually cancel the order yourself.

This is the “set and forget” option. If you place a Buy Limit order on Monday with a GTC duration, it will still be there waiting on Friday, or next Tuesday, or three weeks from now, unless you actively remove it.

2. GFD (Good For the Day) or DAY A GFD order remains active only until the end of the current trading day. The exact cut-off time can vary by broker but is typically around 5:00 PM New York time, which marks the close of the U.S. trading session and the “forex day.” If your pending order has not been filled by this time, the platform will automatically cancel it.

- Why use it? This is useful for day traders whose analysis is only relevant for the current day’s price action. A support or resistance level that is important today might be irrelevant tomorrow after new market information comes out. The trader in our opening story likely had their order set to GFD by default, and it expired before the market opened the next day.

3. Other Variations (Less Common in Retail Forex)

- GTW (Good ‘Til the Weekend/Week): The order remains active until the close of the trading week (Friday afternoon).

- GTT (Good ‘Til Time): You can specify an exact date and time for the order to expire.

Understanding and correctly setting your order’s time-in-force is a crucial part of managing your pending orders. For long-term strategies based on major weekly or monthly levels, GTC is appropriate. For short-term, intraday setups, GFD is often the safer and more logical choice. Always check this setting before placing a pending order to avoid unpleasant surprises.

17. Fill Policies – FOK vs. IOC

We’re now venturing into the more technical side of order execution, delving into concepts that are more prevalent in the worlds of stock and institutional trading but are still good to know for a complete understanding of forex order types. These are fill policies, which dictate how an order should be handled if it cannot be filled completely at a single price.

Imagine you want to buy a very large quantity—say, 1,000 lots (a massive $100 million position)—of EUR/USD. As we discussed in the section on slippage, there might not be enough liquidity (sellers) at the current best price to fill your entire order at once. A fill policy is an additional instruction you give the broker on how to handle this situation.

1. FOK (Fill or Kill) This is the strictest policy. It commands the broker to do one of two things:

- Fill: Execute the entire order immediately at the specified price or better.

- Kill: If the entire order cannot be filled immediately, cancel the whole thing. No partial fills are allowed.

- Why use it? An FOK order is used by traders who need to ensure they get their full position size at a specific price level and are not willing to accept a partial entry. If they can’t get the whole position, they don’t want any of it, as a partial position might not be large enough to justify the trade’s risk or potential profit. This prevents situations where a large order gets filled for only a tiny amount, leaving the trader with a meaningless position.

2. IOC (Immediate or Cancel) This policy is slightly more flexible. It instructs the broker to:

- Immediate: Fill as much of the order as possible immediately at the specified price or better.

- Cancel: Cancel any remaining, unfilled portion of the order.

- Why use it? An IOC order is for traders who want to get as much of their desired position as possible at the current price, but don’t want to wait for the rest of the order to be filled later at a potentially worse price. They are happy to accept a partial fill.

Example: You place a buy order for 1,000 lots of USD/JPY at 145.00. At that exact moment, there are only 300 lots available for sale at that price.

- With an FOK policy: Your entire 1,000-lot order would be cancelled (“killed”) because it couldn’t be filled in its entirety.

- With an IOC policy: Your order would be partially filled for 300 lots. The remaining, unfilled portion of 700 lots would be immediately cancelled.

For most retail forex traders using standard lot sizes, this distinction is largely academic, as the forex market is typically deep and liquid enough to fill standard orders completely. However, understanding these policies gives you a deeper appreciation for the complex mechanics of order execution that happen behind the scenes with every click of your mouse.

18. The Broker’s Role in Order Execution

You click “Buy.” A moment later, a position appears on your screen. It seems like magic. But what actually happens in that fraction of a second? Who is on the other side of your trade? Understanding the broker’s role is critical, as their business model directly impacts how your forex order types are executed.

When you place an order, it’s sent to your broker’s server. What happens next depends on your broker’s execution model. There are two main types:

1. Dealing Desk (DD) Broker / Market Maker A Dealing Desk broker, as the name implies, has a department (the “dealing desk”) that manages order flow. In this model, the broker often takes the other side of your trade.

- When you buy EUR/USD, they sell it to you.

- When you sell GBP/JPY, they buy it from you.

They create a “market” for their clients. Their primary profit comes from the spread (the difference between the bid and ask price). Because they are taking the other side of your trade, there is an inherent potential conflict of interest. If you win, they lose, and vice-versa. To manage their own risk, they may aggregate client positions and hedge their net exposure in the real interbank market. This model can offer benefits like fixed spreads, but it can also lead to issues like re-quotes, where the broker denies your order at the requested price and offers you a new, often worse, price.

2. No Dealing Desk (NDD) Broker An NDD broker does not take the other side of your trade. They act as a bridge, passing your orders directly to liquidity providers (LPs)—which could be major banks, hedge funds, or other financial institutions. NDD brokers come in two main flavors:

- STP (Straight Through Processing): Your order is sent directly to one of the broker’s LPs, who then executes the trade. The broker makes money by adding a small, often fixed, markup to the spread they get from their LP.

- ECN (Electronic Communication Network): This is the most transparent model. Your order is sent to an ECN, which is like a digital marketplace or hub where all participants (banks, institutions, and other traders) can see order flow and compete against each other. This results in very tight, variable spreads, but the broker charges a fixed commission per trade for this access.

Why Does This Matter for Your Orders?

- Execution Quality: NDD brokers (especially ECNs) are generally considered to offer better, faster execution with less chance of re-quotes, as there is no dealing desk intervention. Your order is competing in a live marketplace.

- Slippage: With a market maker, slippage might be more controlled (or even artificial). With an ECN broker, you are exposed to real market liquidity, which means you might experience more slippage during volatile times, but you could also receive positive slippage.

- Spreads: Dealing Desks often offer fixed spreads, which can be good for beginners. NDD brokers offer variable spreads that can be extremely tight in calm markets but can widen significantly during news events.

Choosing a broker is a critical decision. Your sophisticated understanding of forex order types is only as good as the broker executing them. A reputable broker with a transparent execution model (typically ECN/STP) is usually the preferred choice for serious traders.

19. The Psychology of Order Placement

Trader Insight For years, I battled with FOMO—the Fear Of Missing Out. I’d see a big green candle and my heart would pound. My brain would scream, “It’s taking off without you! Get in NOW!” I’d smash the market buy button, only to find I had bought the exact peak of the move, right before it reversed. The market order, for me, became a button of pure emotion. It wasn’t until I forced myself to use only limit and stop orders—to plan my trades in advance—that I finally broke the cycle. My orders became my tools of discipline, not instruments of panic.

Every click you make in your trading platform is a psychological act. The forex order types you choose to use are often a direct reflection of your emotional state. Mastering your trading psychology is, in part, learning to select the order type that aligns with a rational, disciplined mindset, rather than one dictated by fear or greed.

Let’s link the main order types to the psychological states they often represent:

- The Market Order – The Tool of Impatience:

- Emotion: FOMO, greed, panic, the need for instant gratification.

- Mindset: “I need to be in this trade right now, no matter the cost.” It’s reactive. The market is controlling you.

- The Fix: Unless you are a seasoned scalper executing a specific strategy, frequent use of market orders is a red flag. It often signals a lack of planning. Ask yourself: “Am I chasing the market, or is this a planned entry?”

- The Limit Order – The Tool of Patience:

- Emotion: Discipline, confidence, patience, detachment.

- Mindset: “I have analyzed the market, and this is the price at which I see value. I will wait for the market to come to my level.” It’s proactive. You are controlling your engagement with the market.

- The Stop-Loss Order – The Tool of Humility:

- Emotion: Prudence, acceptance, risk-awareness.

- Mindset: “I know that I can be wrong, and I accept that. This is the maximum I am willing to pay to find out if my analysis is correct.” Placing a stop-loss is an act of acknowledging your own fallibility, which is a sign of a mature trader. Refusing to use one is an act of ego.

- The Take-Profit Order – The Tool of Contentment:

- Emotion: Discipline, foresight, greed-management.

- Mindset: “This is my pre-determined goal for this trade. Reaching this goal constitutes a successful trade, and I will be content with that profit.” It protects you from the destructive urge to chase “just a little more profit,” which so often leads to giving it all back.

Your journey to becoming a better trader involves a conscious effort to move away from the impulsive psychology of the market order and towards the patient, planned, and humble psychology embodied by pending orders and protective stops. Your order interface is a mirror of your mindset.

20. Combining Forex Order Types: A Practical Strategy

Theory is one thing; application is another. Let’s walk through a complete, step-by-step case study of how a professional trader might plan and execute a trade from start to finish, combining several of the forex order types we’ve discussed.

The Scenario: We are looking at the daily chart of USD/JPY. The pair is in a strong, established uptrend. It has recently pulled back and is now approaching a significant area of support. This support area is a confluence of three factors:

- A previous swing low at 146.00.

- An ascending trendline that has been respected multiple times.

- The 50% Fibonacci retracement level of the last major upward move.

The current market price is 146.80. Our trading hypothesis is: “The price will drop to the support zone around 146.00, find buyers, and then resume its primary uptrend. The next major resistance is at 149.00.”

Step 1: Choosing the Entry Order

We don’t want to buy now at 146.80; that would be poor value. want to buy at our pre-identified support level. We are anticipating a reversal at that level. The perfect tool for this is a Buy Limit Order.

- Action: Place a Buy Limit order at 146.05, just slightly above the major psychological level to increase the chances of getting filled.

Step 2: Choosing the Protective Stop-Loss Order

Our trade idea is invalidated if the price breaks below the support zone. We need to define our “line in the sand.” A logical place for a stop-loss would be below the trendline and the swing low.

- Action: Place a Stop-Loss Order at 145.45. This gives the trade 60 pips of room to breathe (146.05 entry – 145.45 stop). Our maximum risk is defined.

Step 3: Choosing the Take-Profit Order

Our target is the next major resistance level, which we identified at 149.00.

- Action: Place a Take-Profit Order at 148.95, just slightly below the resistance to ensure it gets filled. This gives us a potential profit of 290 pips (148.95 target – 146.05 entry).

Step 4: Putting It All Together (The OTO Order)

Instead of placing these three orders sequentially, we can use an OTO (One-Triggers-the-Other) or bracket order function. We input all three parameters at once:

- Primary Order: Buy Limit at 146.05.

- Attached Secondary Order 1: Stop-Loss at 145.45.

- Attached Secondary Order 2: Take-Profit at 148.95.

We also set the order duration to GTC (Good ‘Til Cancelled) because this is a swing trade idea based on a daily chart, and it might take a few days for the price to reach our entry level.

The Result:

We have now created a complete, self-managing trade plan.

- Risk: 60 pips.

- Reward: 290 pips.

- Risk/Reward Ratio: Approximately 1:4.8, which is excellent.

We can now walk away from the charts. don’t need to watch the market. If the price drops to 146.05, our trade will be activated, and our protective S/L and T/P will be placed instantly. This structured, multi-order approach is the hallmark of a disciplined and professional trading process. It demonstrates a true mastery over the various types of forex orders and how they work together to execute a strategic plan.

21. Advanced Stop-Loss Strategies

A simple stop-loss placed 50 pips away is good. A smart stop-loss placed strategically is better. Your stop-loss placement should not be arbitrary; it should be based on the market’s own logic and behavior. Simply using a fixed number of pips for every trade is a novice mistake. The market doesn’t care about your fixed number. Here are a few advanced techniques for placing more intelligent stop-losses, a crucial part of risk management in forex.

1. Volatility-Based Stops (Using ATR)

The market’s volatility changes constantly. A 50-pip stop might be appropriate for a slow-moving pair like EUR/CHF, but it could be far too tight for a volatile pair like GBP/JPY. The Average True Range (ATR) indicator is a tool that measures market volatility.

- How it works: The ATR gives you a pip value representing the average trading range over a specific period (e.g., the last 14 days). You can use a multiple of this value to set your stop.

- Example: You are entering a long trade. The 14-day ATR is currently 80 pips. Instead of an arbitrary 50-pip stop, you might place your stop 1.5 times the ATR below your entry (1.5 * 80 = 120 pips). This ensures your stop is outside the “normal” daily noise of the market, making it less likely to be triggered by random fluctuations.

2. Structure-Based Stops

This is the most common method used by technical traders. Instead of focusing on a pip value, you place your stop based on the market’s structure.

- For a Long (Buy) Trade: Place your stop-loss just below the most recent significant swing low or support level. The logic is that if this support level breaks, the original bullish premise for the trade is likely invalid anyway.

- For a Short (Sell) Trade: Place your stop-loss just above the most recent significant swing high or resistance level.

This method respects the market’s own price action rather than imposing an arbitrary risk limit.

3. Time-Based Stops

Sometimes, a trade idea is time-sensitive. The premise isn’t just about price, but also about “price moving soon.” A time-based stop closes your trade if it hasn’t made a profit after a certain amount of time has passed.

- Example: You are a day trader and you buy EUR/USD, expecting a breakout within the London session. Your rule might be: “If this trade is not in profit by the end of the London session, I will close it, even if it hasn’t hit my price-based stop-loss.”

- Why use it? This helps to free up capital from “dead” trades that are going nowhere and not behaving as expected. A good trade should usually start working in your favor relatively quickly.

By evolving your stop-loss strategy from a fixed-pip value to one based on volatility and market structure, you significantly increase the robustness of your trading plan. The stop order is a simple tool, but its application can be highly nuanced and sophisticated.

22. Order Automation and Algorithmic Trading

Have you ever wondered about the world of “trading bots” or “Expert Advisors”? It might sound like science fiction, but a staggering percentage—some estimates say over 70%—of all transactions in financial markets are now executed by automated, algorithmic systems.

What is an algorithm or a trading bot at its core? It is simply a computer program that has been given a set of explicit rules to follow. And what are those rules based on? They are based on executing the very same forex order types we have been discussing in this guide.

An Expert Advisor (EA), the term used for trading bots on the popular MetaTrader platforms (MT4/MT5), is a script that can do two things:

- Analyze the market based on a pre-programmed set of technical indicators or price action rules.

- Execute trades automatically without human intervention.

Let’s look at a very simple EA logic:

- Rule 1 (Entry): IF the 50-period moving average crosses above the 200-period moving average (a “Golden Cross”), THEN place a Market Order to BUY 0.1 lots of EUR/USD.

- Rule 2 (Stop-Loss): WHEN the buy order is filled, immediately place a Stop-Loss Order 1.5 times the current ATR value below the entry price.

- Rule 3 (Take-Profit): AT THE SAME TIME, place a Take-Profit Order 3.0 times the current ATR value above the entry price.

- Rule 4 (Exit): IF the 50-period moving average crosses back below the 200-period moving average (a “Death Cross”), THEN close any open buy positions with a Market Order.

This simple system uses market orders, stop-loss orders, and take-profit orders. More complex algorithms might use limit orders to enter at pullbacks, trailing stops to manage winning trades, or even OCO orders to trade breakouts around news events.

The world of algorithmic trading is a vast and complex field, but it’s important for a beginner to understand that it’s not magic. It is the logical culmination of mastering order execution. These bots are simply executing the same fundamental order types, but with the speed, discipline, and emotional detachment that only a computer can achieve. By learning to use these orders manually, you are learning the very language that powers the world of automated trading.

23. Choosing the Right Order for Market Conditions

A good carpenter doesn’t use a hammer to cut a piece of wood. They match the tool to the task. Similarly, a good trader matches their chosen forex order type to the current market condition or “regime.” A strategy that works wonderfully in a trending market will likely fail miserably in a sideways, ranging market.

Here is a quick reference guide to help you select the most appropriate order types for different market environments.

1. For a Strong, Trending Market (Clear Uptrend or Downtrend)

This market is characterized by higher highs and higher lows (uptrend) or lower lows and lower highs (downtrend).

- Best Entry Orders:

- Buy Stops / Sell Stops: To enter on breakouts in the direction of the trend.

- Buy Limits / Sell Limits: To enter on pullbacks to key levels like moving averages or trendlines within the trend. This is often seen as a more advanced, higher-value entry.

- Best Management Orders:

- Trailing Stops: This is the ideal environment for a trailing stop, as it allows you to ride the trend for as long as possible while locking in profits.

2. For a Sideways, Ranging Market

This market is characterized by price bouncing between a clear level of support and a clear level of resistance.

- Best Entry Orders:

- Buy Limits: Place them at or near the support level, anticipating a bounce up.

- Sell Limits: Place them at or near the resistance level, anticipating a rejection down.

- Orders to Avoid:

- Buy Stops / Sell Stops: These are very risky here. Placing a buy stop just above resistance in a range is a classic way to get caught in a “fakeout” or “bull trap.”

3. For a Highly Volatile, News-Driven Market

This market is characterized by wild price swings, wide spreads, and the potential for significant slippage. This is common around major news releases.

- Best Orders (if you must trade):

- Limit Orders: A limit order is the only way to protect yourself from severe negative slippage on entry.

- Orders to Avoid:

- Market Orders: Using a market order during NFP is financial suicide. The slippage can be immense.

- Stop Orders (for entry): While used for breakout strategies, be aware that a stop order becomes a market order when triggered, so it too is susceptible to slippage.

Quick Reference Table

By first identifying the type of market you are in, you can then select the most appropriate tools—the best types of forex orders—for the job, dramatically increasing your strategic effectiveness.

24. Common Order Placement Mistakes and How to Fix Them

Learning about forex order types is one thing, but avoiding the common pitfalls in their application is what separates profitable traders from the rest. Here are some of the most frequent mistakes beginners make and how to correct them.

1- Mistake : Placing Stop-Losses Too Tight

- The Mistake: A trader, fearing loss, sets their stop-loss just a few pips away from their entry. They get stopped out by a minor, random price fluctuation, only to watch the market then proceed to move in their intended direction without them. This is often what traders are referring to when they complain about “stop hunting.”

- The Fix: Give your trade room to breathe. Use a volatility-based stop (like one based on the ATR) or place your stop on the other side of a logical market structure (like a swing high/low). A wider, strategically placed stop is often safer than a tight, arbitrary one.

2- Mistake : Chasing the Market with Market Orders

- The Mistake: Seeing a currency pair making a strong move, the trader is gripped by FOMO and uses a market order to jump in late. They often end up buying the very top or selling the very bottom, right before a reversal.

- The Fix: Cultivate patience. If you miss the initial move, wait for a pullback. Use a limit order to plan an entry at a better price. If the market doesn’t give you a good entry, then you don’t trade. There will always be another opportunity.

3- Mistake : Not Placing a Stop-Loss at All

- The Mistake: A trader enters a position and, out of overconfidence or negligence, fails to set a stop-loss. They tell themselves they will “watch the trade” and close it manually if it goes wrong. This is the single deadliest mistake in trading.

- The Fix: This is non-negotiable. Make it a rigid, unbreakable rule: Every single trade must have a pre-defined stop-loss from the moment it is opened. No exceptions, ever.

4- Mistake : Moving Your Stop-Loss to Avoid a Loss

- The Mistake: The price is moving against a trader and approaching their stop-loss. Instead of accepting the small, planned loss, they move their stop-loss further away, thinking “it will turn around soon.” This turns a small, disciplined loss into a large, emotional one.

- The Fix: Treat your initial stop-loss as sacred. Once it is set, you should never move it further away from your entry price. The only time you should ever move a stop-loss is in the direction of your trade (e.g., to break-even or into profit), which is what a trailing stop automates.

By being mindful of these common errors, you can avoid a huge amount of financial and emotional pain on your trading journey.

25. Mastering Your Trading Platform’s Order Interface

Knowledge is useless without action. The final step in mastering forex order types is to become intimately familiar with your trading platform’s order window. The best way to do this is to open a risk-free demo account and practice.

While every platform (like MetaTrader 4/5, cTrader, or TradingView) looks slightly different, the order interface will contain the same core components. Let’s walk through a typical order window.

1. Symbol: This is where you select the currency pair you want to trade (e.g., EUR/USD, GBP/JPY).

2. Volume / Lot Size: This is where you specify your position size. It will be expressed in lots (e.g., 1.00 for a standard lot, 0.10 for a mini lot, 0.01 for a micro lot). This is a critical risk management setting.

3. Stop Loss: A dedicated field where you enter the exact price for your stop-loss order. Some platforms also allow you to enter it in pips away from the entry price.

4. Take Profit: A dedicated field for your take-profit order’s price.

5. Comment: An optional field where you can add a note to your trade (e.g., “Entry based on daily support bounce”). This is excellent for journaling and reviewing your trades later.

6. Type: This is the most important dropdown menu. Here you will choose between:

- Market Execution (or Instant Execution): This will activate the “Sell by Market” and “Buy by Market” buttons.

- Pending Order: Selecting this will reveal a new set of options.

If you select “Pending Order”:

- Type (again): A second dropdown will appear where you must specify which of the four main pending orders you want to use: Buy Limit, Sell Limit, Buy Stop, or Sell Stop.

- at price: This is the field where you set the specific price level at which you want your pending order to be triggered.

- Expiry: This is where you can set the order’s duration (e.g., GTC, GFD, or a specific date).

Call to Action: Your Homework

- Open your demo trading account.

- Choose any currency pair.

- Practice placing every single order type we have discussed:

- Place a market buy order. Immediately add a S/L and T/P to it.

- Place a Buy Limit order below the current price.

- Place a Sell Limit order above the current price.

- Place a Buy Stop order above the current price.

- Place a Sell Stop order below the current price.

- Once a pending order is filled, practice modifying its S/L and T/P.

- Explore your platform’s settings for OCO or bracket orders.

Touching the buttons and seeing how the orders appear on your chart will move this knowledge from your head to your fingertips. Confidence in your execution is a cornerstone of a confident trading mindset.

Conclusion: From Instructions to Intuition

We began this journey with the analogy of a chef and their tools. Over the past 25 sections, we have systematically unpacked that entire toolkit. We have moved far beyond the simple “buy” and “sell” buttons to uncover a world of strategic commands that give you control over price, time, risk, and your own emotions.

Mastering forex order types is not a one-time task but a foundational skill that will serve you throughout your entire trading career. You’ve learned that a market order offers speed at the cost of price, while a limit order provides price precision at the cost of guaranteed execution. You’ve seen how stop orders can be used both defensively as a vital stop-loss and offensively as a tool for trading breakouts. We’ve explored how combining these orders with OCO and OTO functionalities can create fully automated, disciplined trading plans.

But more importantly, you should now understand that each order type is a reflection of a strategy and a mindset. They are the practical bridge between your analysis on the chart and your actions in the market. Using them correctly transforms you from a passive gambler tossed about by market waves into a strategic sailor who sets their sails, plots their course, and navigates with a firm hand on the tiller.

The knowledge is now yours. The next step is to apply it. Go to your demo account. Practice until placing a bracket order feels as natural as tying your shoes. Let this deep understanding of your tools build a foundation of confidence and discipline. In the dynamic and challenging world of forex, that foundation is your single greatest asset.

Frequently Asked Questions (FAQ) about Forex Order Types

1. What are the main forex order types? The main forex order types can be grouped into two categories. First are Market Orders, which execute a trade immediately at the best available price. Second are Pending Orders, which execute only when a specific price is reached. The four main types of pending orders are the Buy Limit, Sell Limit, Buy Stop, and Sell Stop. Additionally, crucial protective orders include the Stop-Loss and Take-Profit.

2. Which forex order is safest for beginners? The “safest” practice for a beginner is not a single order type, but a combination: using a Limit Order for entry and always attaching a Stop-Loss Order to it immediately. A limit order protects you from slippage and forces you to be patient. A stop-loss order protects your capital from large, unexpected losses, which is the most critical aspect of risk management for any new trader.

3. What is the difference between stop and limit orders? The key difference lies in the intended price of execution relative to the current market price. A Limit Order is used to get a better price than the current price (buying below the market or selling above it). It’s used for reversal strategies. A Stop Order is used to get a worse price than the current price (buying above the market or selling below it). It’s used for breakout or continuation strategies, or as a stop-loss to exit a losing trade.

4. How do pending orders work? Pending Orders are instructions you give your broker that remain dormant until a specific price condition is met. You pre-define the entry price, and if the market’s bid or ask price reaches that level, the pending order is triggered and becomes either a market order (in the case of stop orders) or is filled at that price or better (in the case of limit orders). They allow traders to plan their trades in advance and execute them automatically without having to watch the market constantly.

5. How can I use order types for better risk management? The most critical way to use forex order types for risk management is the disciplined application of the Stop-Loss Order on every single trade to define your maximum acceptable loss. Furthermore, using Limit Orders helps manage the risk of slippage on entry. Using a Take-Profit Orderhelps manage the risk of greed by locking in profits systematically. Finally, a Trailing Stop Order is an excellent tool for managing risk on a winning trade, protecting open profits while allowing the trade to continue in your favor.

Resources

1. Investopedia – Forex Orders Explained

Purpose: Educational overview of major order types (market, limit, stop, etc.).

Intro: A clear, beginner-focused explanation of how each order type works, when to use them, and how they affect your trading results.

https://www.investopedia.com/articles/forex/06/typesoforders.asp

2. Babypips – Types of Forex Orders

Purpose: Step-by-step learning guide for new traders.

Intro: Babypips breaks down forex order types in simple terms, with practical examples and illustrations that make learning easier.

https://www.babypips.com/learn/forex/types-of-forex-orders

3. OANDA – How to Place Forex Orders

Purpose: Platform-based tutorial and execution examples.

Intro: A useful resource from a top forex broker showing how to place market, limit, and stop orders directly on a trading platform.

https://www.oanda.com/us-en/trading/forex-trading/orders/

4. FXCM – Order Types and Execution

Purpose: Understanding broker-side order processing.

Intro: FXCM explains how different order types are executed in real-world conditions, including slippage, liquidity, and trade confirmation.

https://www.fxcm.com/uk/insights/forex-order-types/

5. IG Academy – How Forex Orders Work

Purpose: Interactive educational lessons on forex orders.

Intro: IG Academy offers short, interactive lessons for beginners covering order entry, stop loss placement, and trade management.

https://www.ig.com/en/forex/what-is-a-forex-order