Fibonacci extension is a powerful and key tool in technical analysis that provides significant assistance to traders in areas such as Forex, stock markets, cryptocurrencies, and other financial markets. This analytical tool, derived from the Fibonacci sequence, enables traders to determine potential profit-taking levels. By learning and practicing accurate and correct drawing of Fibonacci extensions, traders can better identify price advancements following the completion of a corrective move or pullback.

The most important feature of this tool is its various ratios, including 161.8%, 200%, and 261.8%. These ratios are based on the Fibonacci sequence and allow traders to predict future price levels with greater accuracy. This is especially useful in highly volatile markets like cryptocurrencies.

Fibonacci extension not only helps in identifying support and resistance levels but is also effective in pinpointing long-term and short-term price targets. This tool enables traders to plan their trading strategies more precisely and make decisions based on reliable data and analyses. Additionally, when combined with other technical analysis tools such as indicators and chart patterns, it can be part of a comprehensive trading approach.

What is Fibonacci Extension?

Fibonacci extension is a tool that assists traders in analyzing price trends, especially in determining significant price levels after prices have reached their highs or lows in an uptrend or downtrend. This tool, by using points marked on the chart as 100% Fibonacci, allows traders to predict price targets. It is particularly useful when prices exceed the 100% level in Fibonacci and reach higher points.

By using Fibonacci extension, one can estimate where prices will reach beyond their 100% level and observe market reactions at these levels. These reactions typically involve significant price fluctuations and are important for long-term investments.

Fibonacci extension, like other Fibonacci tools, has multiple levels including 127.2%, 161.8%, 261.8%, and 263.6%. These levels can be used in both bullish and bearish market conditions. The crucial aspect is that prices must move beyond their previous wave and show significant reactions.

Using Fibonacci extension allows traders to easily identify support and resistance levels on the chart. In the following section, methods for drawing this Fibonacci tool on the chart and how to use it will be explained in more detail. This tool enables traders to analyze price movements with greater precision and implement more successful trading strategies.

How to Draw Fibonacci Extension

To draw Fibonacci extension on a chart, first select the “Gann and Fibonacci tools” from the menu and then activate the “Retracement” option. This step initiates the drawing process. Next, you need to identify a primary trend where price changes and market fluctuations are clearly visible.

If the primary trend is bullish, you will then see a bearish corrective chart. Conversely, if the primary trend is bearish, you will see a bullish corrective chart. Identifying the primary trend and its corrective wave is based on your analysis and decision.

After identifying the corrective chart, you need to mark the highest and lowest levels of the correction. This is done by clicking on the highest part (for the highest level) and then clicking on the lowest part (for the lowest level).

Next, connect these two points. This connection is made from the highest corrective level to the lowest level. This completes the drawing on the chart.

For bearish trends, the process is entirely reversed. In this case, you first identify the primary bearish trend and then analyze the bullish corrective chart. This time, you select the lowest point and then connect it to the highest point. This method, whether in bullish or bearish markets, helps traders understand key support and resistance points and make more accurate trading decisions.

Using Fibonacci Extension

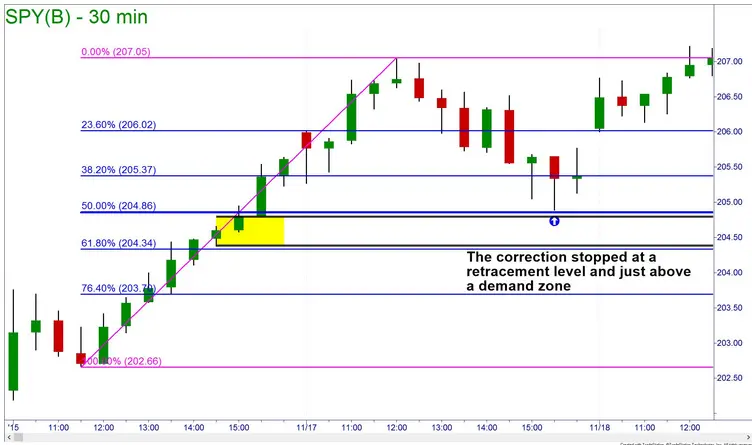

Fibonacci extension is an effective approach in financial market chart analysis for predicting price trends. In an uptrend, Fibonacci extension helps identify support levels. For example, when the Fibonacci level reaches 50%, this area acts as a support reaction. In such conditions, buyers gain strength and push the stock price higher. When the price surpasses the highest price level, Fibonacci extension shows where to enter trades.

In an uptrend, after a price increase, a price correction often occurs. If the price decreases to 38.2% and then rises again to reach the 100% Fibonacci level, it is expected that the price may exceed the previous high in the coming hours or days, potentially reaching the 161.8% level. At these points, resistance may be encountered, so determining the optimal entry point between the 100% and 161.8% levels is crucial.

Conversely, in a downtrend, Fibonacci extension helps analysts identify support levels. Suppose a downtrend occurs in the financial market and the price decreases to a certain extent. Then, due to the creation of a support area, the price rises again to around 50%. In this case, an analyst needs to know exactly where to enter the trade.

Support levels in downtrends are often found at levels like 61.8%, 50%, and 38.2%. Analysts pay special attention to these points and try to capitalize on trading opportunities in these areas. Thus, Fibonacci extension is an effective tool for determining entry and exit points in both uptrending and downtrending markets.

Application of Fibonacci Extension

Fibonacci extension is a key tool in financial market analysis, primarily used to assess and calculate price changes beyond the zero to hundred percent range. This tool helps traders identify critical profit and loss points when prices exceed typical maximum and minimum levels.

Fibonacci extension is especially useful in highly volatile market conditions, where analysts and traders seek to determine entry and exit points in ranges beyond conventional price boundaries. By using specific Fibonacci ratios such as 161.8%, 261.8%, and 423.6%, traders can predict the next price range with greater accuracy.

Using Fibonacci extension can assist traders in identifying effective entry and exit points and allows them to build their trading strategies based on more precise and reliable analyses. This tool is useful not only for setting profit and loss limits but also for identifying potential support and resistance levels in new price ranges.

In summary, Fibonacci extension is a powerful technical analysis tool that helps traders identify profitable opportunities in financial markets, particularly when prices move beyond conventional ranges.

How to Trade with Fibonacci Extension

To succeed in trading using Fibonacci extension, paying close attention to support and resistance levels in the market is crucial. Fibonacci extension helps you identify potential key points where the market may experience price increases or decreases. It’s important to decide in advance which market trend you want to analyze.

For instance, if you are analyzing a downtrend, you should predict significant support levels and use Fibonacci extension to analyze results when these areas are reached. The key aspect of using Fibonacci extension is to accurately determine the right moment to enter a trade. While it is possible to identify support and resistance levels without this tool, Fibonacci extension provides a deeper and more precise perspective.

When using Fibonacci extension, it is important to identify points with profit potential. After determining these points, you can base your trades on this analysis. Ultimately, this approach helps improve your trading strategy and achieve greater profitability.

Difference Between Fibonacci Numbers and Fibonacci Extension Levels

Each type of Fibonacci tool has specific levels that are effective in analyzing support and resistance points, determining entry points, and setting profit and loss limits. Fibonacci retracement allows analysts to examine future price trends on the chart. Notably, Fibonacci retracement and Fibonacci extension have fundamental differences. Fibonacci retracement levels are within the 0% to 100% range, meaning that in uptrends or downtrends, a retracement line is observed within this range.

Before reaching the 0% to 100% range, you may observe a column indicated by Fibonacci retracement, which allows for the analysis and prediction of future market prices. In contrast, Fibonacci extension levels are different from retracement levels as they lie outside the 0% to 100% range. These levels are used when prices exceed the highest peak or lowest trough, presenting profit opportunities beyond this range. Professional analysts can determine the best entry points and potentially earn significant profits before the market changes.

Fibonacci retracement levels include 0%, 23.6%, 38.2%, 61.8%, 78.6%, and 100%. These levels, located between zero and one hundred, also include zero and one hundred as significant levels. The most prominent level in both Fibonacci tools is the 50% level, which may indicate a shift to support or resistance. Fibonacci extension levels include 161.8%, 261.8%, and 423.6%, which fall outside the zero to one hundred range.

Setting Stop Loss and Take Profit with Fibonacci Extension

Determining stop loss and take profit levels using Fibonacci extension is a crucial aspect of trading in financial markets. Fibonacci extension alone is not a complete tool for setting these limits. Relying solely on this tool for setting stop loss and take profit levels can carry high risk and may result in losses for traders. Utilizing other indicators alongside Fibonacci extension can aid in more accurate chart analysis and better decision-making. A key recommendation when using it is to set your stop loss above critical price levels, such as peaks and troughs.

The same principle applies to Fibonacci retracement. For instance, first, identify your initial target point and then set your stop loss at the next level. Suppose you intend to enter a trade at the 38.2% level; your stop loss should be set at the 50% level. If your entry point is at 162.8%, the stop loss should be set at the 261.8% level. Take profit levels in Fibonacci extension have been discussed in previous sections.

By identifying support and resistance points, you can pinpoint at least three significant take profit levels on the chart. Placing indicators at these points allows you to enter profitable trades. The most important aspect of setting take profit levels using Fibonacci extension is accurately identifying support and resistance points, which are crucial for making entry or exit decisions in trades.

Differences Between Fibonacci Extension, Fibonacci Projection, and Fibonacci Retracement

Fibonacci Extension:

- Purpose: Fibonacci extension is used to identify potential price targets beyond the typical 0-100% range. It helps traders anticipate possible future price levels in a strong trend or breakout situation.

- Usage: It is particularly useful when the price extends beyond recent highs or lows. Key levels include 161.8%, 261.8%, and 423.6%, which help traders identify potential areas for take profit or future resistance/support.

- Application: It is used to predict price movements once the price has moved beyond its previous extreme. For instance, after a trend breakout, Fibonacci extension can help find potential levels where the price might reach next.

Fibonacci Projection:

- Purpose: Fibonacci projection is designed to estimate the end of a trend. It helps traders forecast potential price levels where the trend might continue based on an extension of the current trend.

- Usage: This tool uses three key points on a chart: the start of the move, the end of the move, and a retracement point. By projecting these points, traders can estimate where the trend might extend.

- Application: It is typically used when traders want to determine the potential extension of a current trend, often after a retracement has occurred. It projects possible future price targets based on the current trend’s strength.

Fibonacci Retracement:

- Purpose: Fibonacci retracement is used to identify potential support and resistance levels during a correction or pullback within a trend. It helps traders pinpoint where the price might reverse or find temporary support/resistance.

- Usage: The key levels are 23.6%, 38.2%, 50%, 61.8%, and 78.6%, which are applied between the high and low of a trend. These levels indicate where the price might retrace before continuing in the direction of the original trend.

- Application: It is useful during corrections within a trend to find possible entry points or levels where the price might reverse direction.

Summary:

- Fibonacci Extension is for predicting price levels beyond the norm, useful for identifying take profit points in a strong trend.

- Fibonacci Projection helps forecast the end of a trend and possible continuation points based on current trend analysis.

- Fibonacci Retracement identifies potential support and resistance levels during a trend correction or pullback.

Conclusion

Fibonacci extension is a valuable tool for identifying potential future price levels and maximizing profit in trending markets. It complements other tools like Fibonacci retracement and projection, which offer insights into different aspects of market movements. By integrating these tools and combining them with other technical indicators, traders can enhance their decision-making and improve their trading strategies.