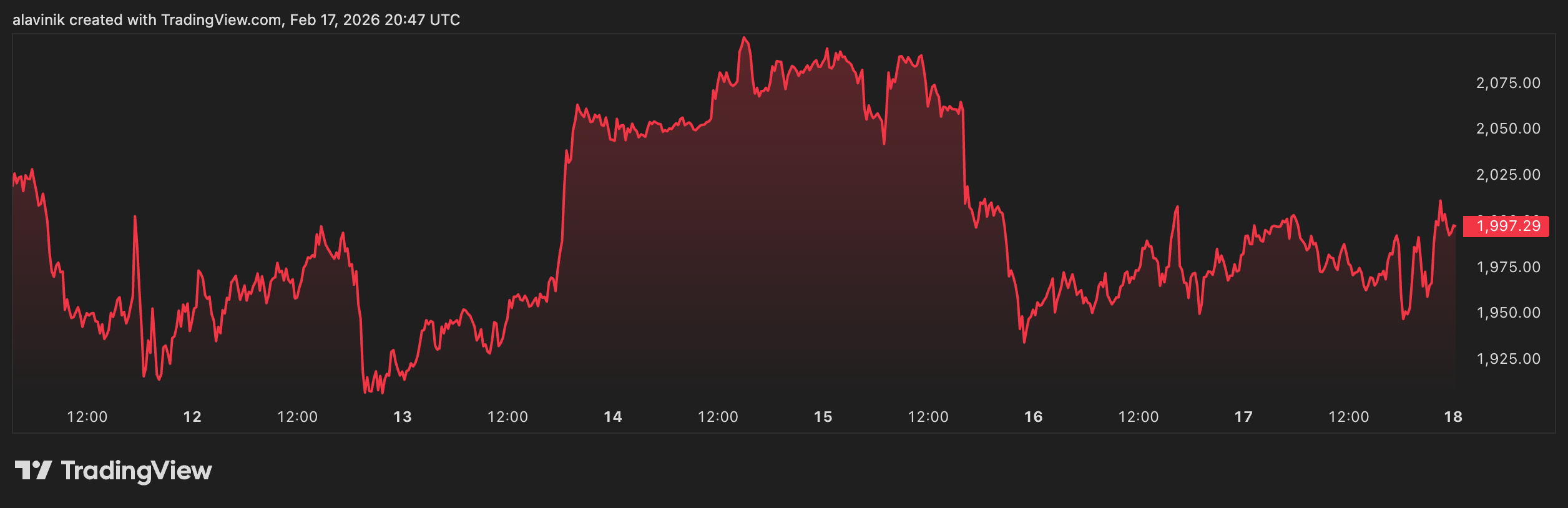

Since you’ve got your eyes on Ethereum’s $2,000 baseline, let’s actually break down both sides of the coin: the Layer-2 TVL war and the technical setup for ETH/BTC. Both are screaming that Ethereum is going through a massive structural shift right now in February 2026.

⛓️ The Layer-2 TVL War: The Liquidity Black Holes

Right now, the total value locked (TVL) across the Ethereum ecosystem is sitting around a massive $55 Billion, but the real battle is happening up on Layer-2. The network is scaling exactly how it was designed to, but the liquidity is consolidating among a few heavyweights.

Here is how the top of the L2 leaderboard is shaping up:

Arbitrum One (~$17.2B): Still the undisputed king of DeFi on L2. It has the deepest liquidity pools and remains the default deployment zone for veteran protocols.

Base (~$10.7B): This is the undisputed momentum play. Coinbase’s L2 has been on an absolute tear, recently crossing the $10 billion mark. It is absorbing retail liquidity and consumer apps faster than anyone else in the space.

OP Mainnet (~$2.0B): Optimism is holding strong in third, but its real superpower right now is the “Superchain” thesis—attracting other networks (like Base itself) to build on its OP Stack.

The Wildcards: We’re also seeing crazy new entrants like MegaETH, which just launched its mainnet promising 100,000 TPS, instantly grabbing $66 million in TVL within its first week.

The Takeaway: The “fat protocol” thesis is playing out perfectly. Ethereum is outsourcing its execution to these L2s, meaning the base layer is becoming a pure settlement and security engine. If Base and Arbitrum keep growing at this rate, the fee revenue flowing back down to Ethereum stakers will be massive.

📉 ETH/BTC: The Coiled Spring

Forget the USD price for a second. If you want to know when institutional capital is truly rotating from safe-haven plays back into high-growth tech, you have to look at the ETH/BTC ratio.

Right now, the ratio is sitting at a brutal 0.029 BTC. Here is the reality check on what the charts are telling us:

Heavy Compression: Ethereum has been trapped under a multi-year descending resistance line against Bitcoin. Every time it rallies, people scream “flippening,” and then it cools off. At 0.029, ETH is deep in its historical decline zone and testing the patience of even the most hardcore believers.

The Supply Squeeze: Here is the catch—over 30% of the entire ETH supply is currently staked and locked up. There is less liquid ETH floating around on exchanges than ever before.

The Setup: Because the supply is so tight, the market isn’t fundamentally weak; it’s compressed. It only takes a slight shift in demand—like a successful Pectra upgrade execution or a slight dip in Bitcoin dominance—to act as the spark.

If ETH/BTC can break and hold above the 0.032 resistance level, the narrative flips overnight. That is the exact trigger point where algorithmic traders and institutions stop treating Bitcoin as a safe haven and start treating Ethereum as the ultimate tech-growth play.

Are you positioning more toward the L2 ecosystem tokens right now (like ARB or OP), or are you accumulating pure ETH waiting for that ratio to finally snap back?