بازار معاملات دوطرفه به چه معناست ؟

بصورت کلی دو نوع بازار یا مارکت داریم . بازار های یک طرفه و دوطرفه .

در بازار های یک طرفه مانند بورس تهران شما می توانید با آورده مالی خود سهامی را بخرید و بعد از گذشت زمان سهامی را که خریده اید با سود یا زیان بفروشید .

اما و به این ترتیب از کاهش قیمت ها هم سود کنید .

معاملات یک طرفه

همانطور که گفته شد شما در این گونه معاملات ، با خرید یک سهام می توانید پس از مدتی سهام خود را بفروشید و در این حالت درصورتیکه سهام شما در این مدت شاهد افزایش قیمت بوده ، شما سود کرده اید و بالعکس شما با پایین رفتن قیمت سهام دچار زیان شده اید .

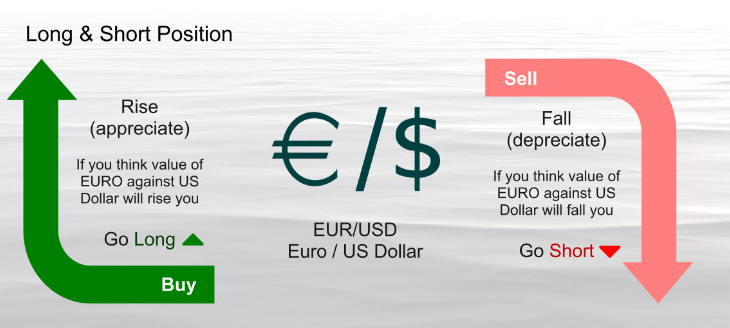

معاملات دوطرفه

در معاملات دوطرفه شما حتی درصورتیکه قبلا سهامی را نخریده اید ، می توانید پوزیشن فروش روی آن گرفته و از تغییرات قیمتی آن سود یا زیان کنید .

درصورتیکه شما وارد معامله فروش شده باشید ، به شرط کاهش قیمت سهام مورد نظر شما سود کرده اید .

اصطلاحات :

Long :

باز کردن پوزیشن خرید : وقتی شما به منظور ورود به معامله خرید ، اقدام به خرید سهام یا کالایی می کنید به آن (لانگ) گفته می شود .

Short :

باز کردن موقعیت فروش : وقتی شما به منظور ورود به معامله فروش ، اقدام به فروش سهام یا کالایی می کنید (شورت) گفته می شود .