The Institutional Rotation: Why Smart Money is Anchoring Ethereum at $2,000

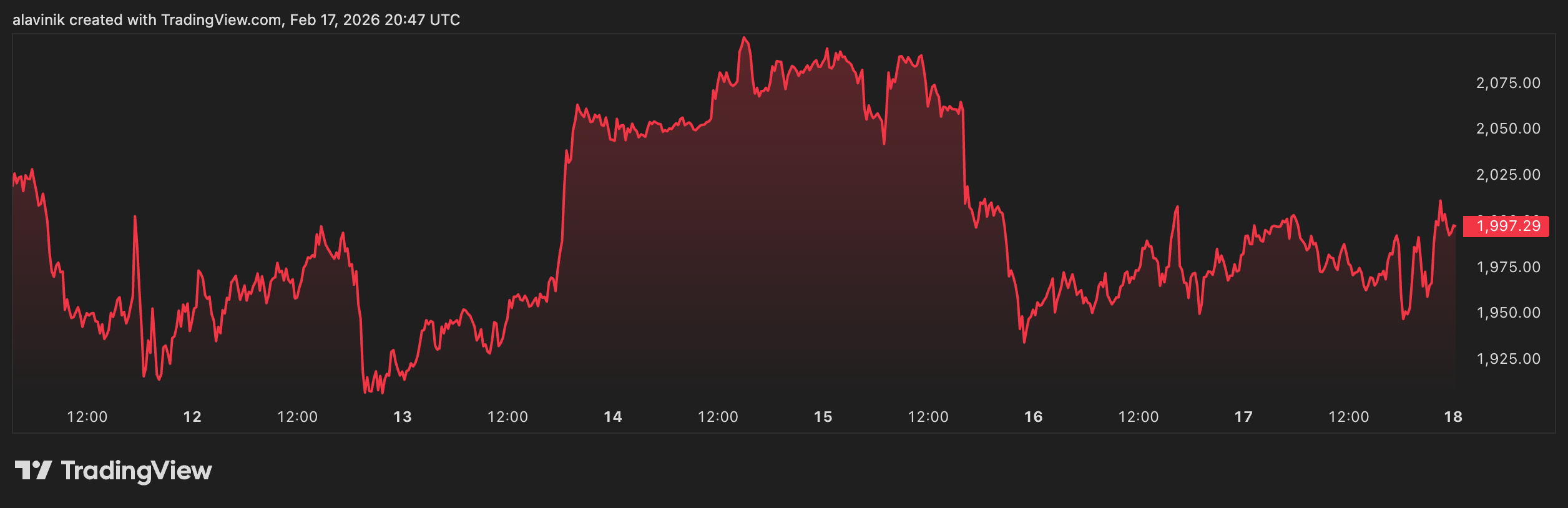

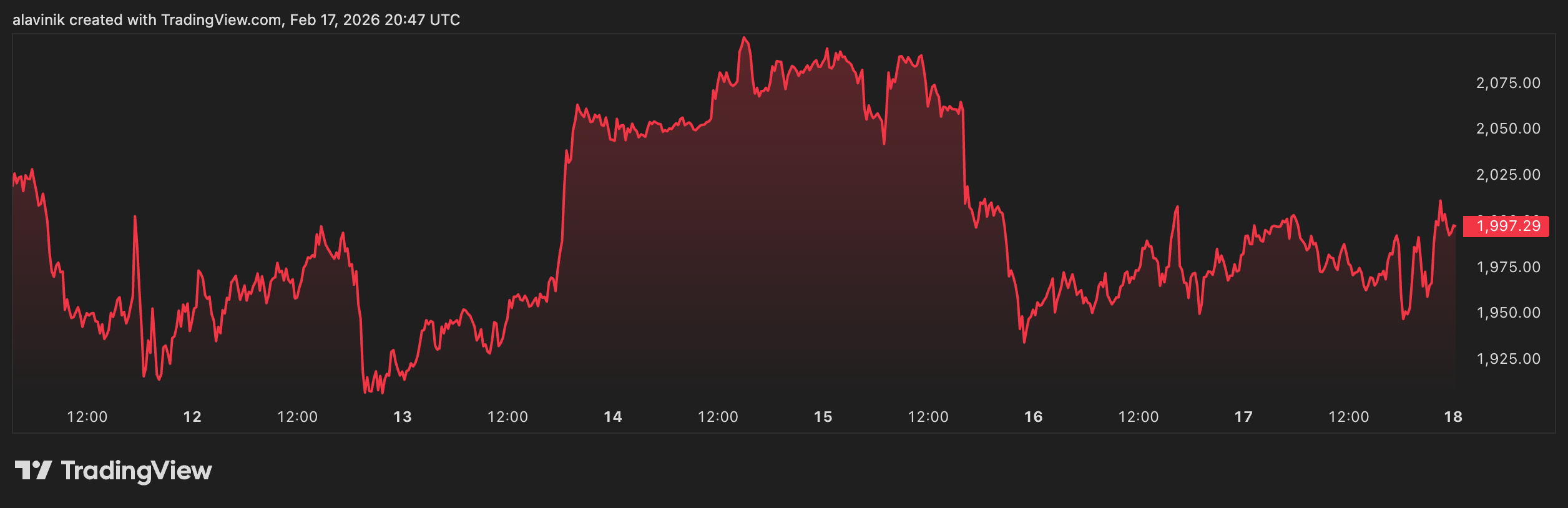

Since you’ve got your eyes on Ethereum’s $2,000 baseline, let’s actually break down both sides of the coin: the Layer-2 TVL war and the technical

The crypto analysis cycle is a 24/7 firehose of noise. One minute, an influencer is promising a 100x gem. The next, a “FUD” (Fear, Uncertainty, Doubt) article is claiming crypto is dead. 99% of this is designed to do one of two things: get you to click (ad revenue) or get you to buy (so they can sell).

Since you’ve got your eyes on Ethereum’s $2,000 baseline, let’s actually break down both sides of the coin: the Layer-2 TVL war and the technical

The rules just changed. Trump’s nod to Kevin Warsh as the next Fed Chair isn’t just a personnel change; it’s a regime shift. The market

The market just had a heart attack and was resuscitated in the same trading session. The “Greenland Tariff” scare wasn’t just noise; it was a

The Dollar didn’t just stumble; it broke its ankle. With the DXY shattering the 97 handle, we are witnessing the start of a “Currency Regime

The global financial system is currently undergoing a “Liquidity Shock” event. The Yen is snapping back like a rubber band, decapitating the carry trade that

The old correlations are dead. We are witnessing the “Great Decoupling,” where Gold screams “systemic risk” while Equities whisper “soft landing.” The dollar is bleeding

The ocean is deep, and the big fish eat the small fish. In the crypto markets, you are not the predator; you are the plankton.

Every empire falls eventually. It is not a matter of if, but when. The math doesn’t care about your patriotism, and the bond market doesn’t